12 Edwina, a commodities broker, has acquired an option to buy 1,000 oz of gold at $50/oz....

Question:

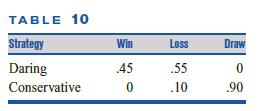

12 Edwina, a commodities broker, has acquired an option to buy 1,000 oz of gold at $50/oz. If she takes the option and if Congress relaxes import quotas, she can sell the gold for

$80/oz. If she takes the option and Congress does not relax the import quotas, however, the company will lose $10/oz.

Edwina believes that there is a 50% chance that the government will relax the quota. She also has the option of waiting until Congress decides whether to relax the import quota. If she adopts this strategy, however, there is a 70% chance that some other broker will have already taken the option.

a If Edwina is risk-neutral, what should she do?

b If Edwina’s utility function for a change x in her asset position is given by u(x) (10,000 x)1/2, what should she do?

Step by Step Answer:

Operations Research Applications And Algorithms

ISBN: 9780534380588

4th Edition

Authors: Wayne L. Winston