23 Arthur Ross, Inc., must complete many corporate tax returns during the period February 15April 15. This

Question:

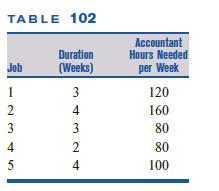

23 Arthur Ross, Inc., must complete many corporate tax returns during the period February 15–April 15. This year the company must begin and complete the five jobs shown in Table 102 during this eight-week period. Arthur Ross employs four full-time accountants who normally work 40 hours per week. If necessary, however, they will work up to 20 hours of overtime per week for which they are paid $100 per hour. Use integer programming to determine how Arthur Ross can minimize the overtime cost incurred in completing all jobs by April 15.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Operations Research Applications And Algorithms

ISBN: 9780534380588

4th Edition

Authors: Wayne L. Winston

Question Posted: