1. The total payroll tax expense incurred by the employer on salaries and wages paid during the quarter ended December 31 was.....................$ 2. The total

1. The total payroll tax expense incurred by the employer on salaries and wages paid during the quarter ended December 31 was.....................$

2. The total payroll tax expense incurred by the employer on the total earnings of Joseph T. O’Neill during the fourth quarter was .................$

3. The amount of the group insurance premiums collected from employees during the quarter ended December 31 was ..................................$

4. O’Neill has decided to give all current employees (excluding himself) a bonus payment during January equal to 5% of their total gross pay for last year. Determine the total of this bonus payment ..............................$

5. On the financial statements prepared at the end of its first year of operations, the company must show an accurate picture of all expenses and all liabilities incurred. The last payday of the year was December 18. However, the payment to the employees on that day did not include the weeks ending December 19 and 26 and the four days (December 28–31) in the following week.

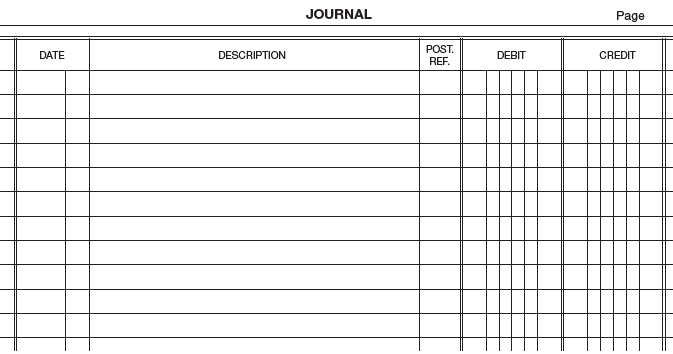

These earnings will be reflected in the January payrolls. Two-column journal paper is provided for use in journalizing the following entry on page 7-23.

Prepare the adjusting entry as of December 31 to record the salaries and wages that have accrued but remain unpaid as of the end of the year.

When calculating the amount of the accrual for each hourly worker, assume each employee worked eight hours on each day during the period with no overtime (student works a 36-hour week—student worked 32 hours for the period December 28 through December 31). For each salaried worker, the accrual will amount to 14/10 of the worker’s biweekly earnings, except for Zimmerman who worked only 10 days.

Each of the labor cost accounts should be debited for the appropriate amount of the accrual, and Salaries and Wages Payable should be credited for the total amount of the accrual. There is no liability for payroll taxes on the accrued salaries and wages until the workers are actually paid. Therefore, the company follows the practice of not accruing payroll taxes.

6. Also, prepare the adjusting entry as of December 31 to record the accrued vacation pay as of the end of the year. Record the expense in a vacation benefits expense account, and credit the appropriate liability account. Use the journal paper provided.

As of December 31, the vacation time earned but not used by each employee is listed here.

Bonno....................................... 80 hours

Ferguson................................... three weeks

Ford.......................................... two weeks

Mann........................................ one week

O’Neill...................................... four weeks

Ryan......................................... 80 hours

Sokowski................................... two weeks

Student...................................... 72 hours

Woods....................................... none

Young........................................ none

Zimmerman.............................. none

JOURNAL Page POST. DATE DESCRIPTION DEBIT CREDIT REF.

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Total of employers FICA tax entries 1288272 FUTA tax 4830 SUTA tax 70075 Total payroll tax expense ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards