5.5 For the February 10, 2023, pay period, use the gross pay totals from the end of...

Question:

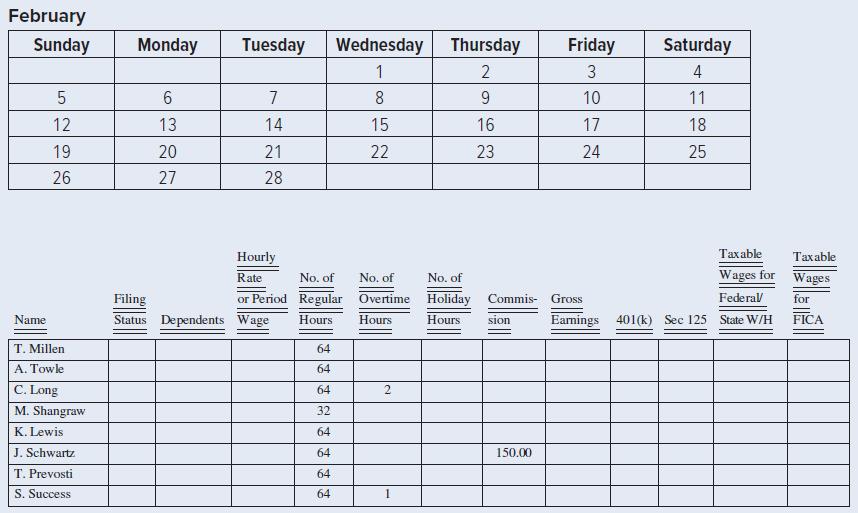

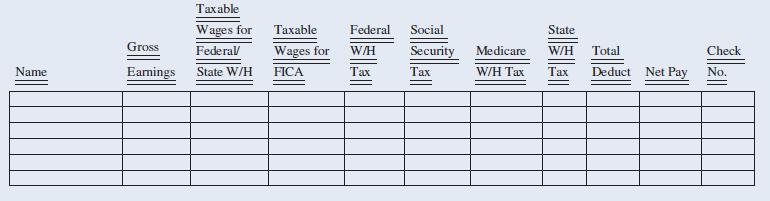

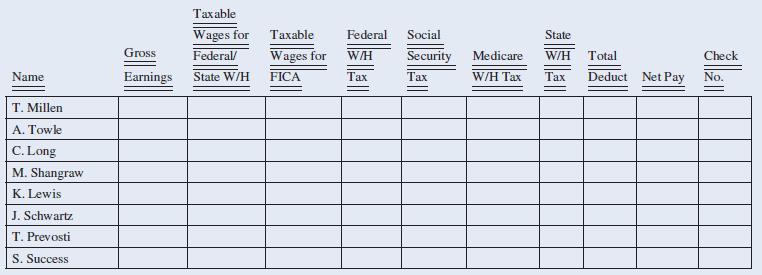

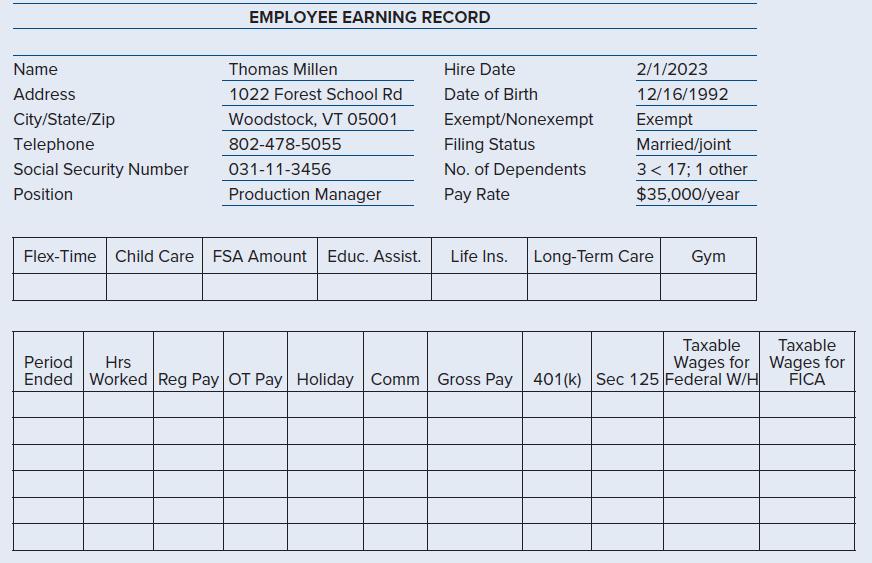

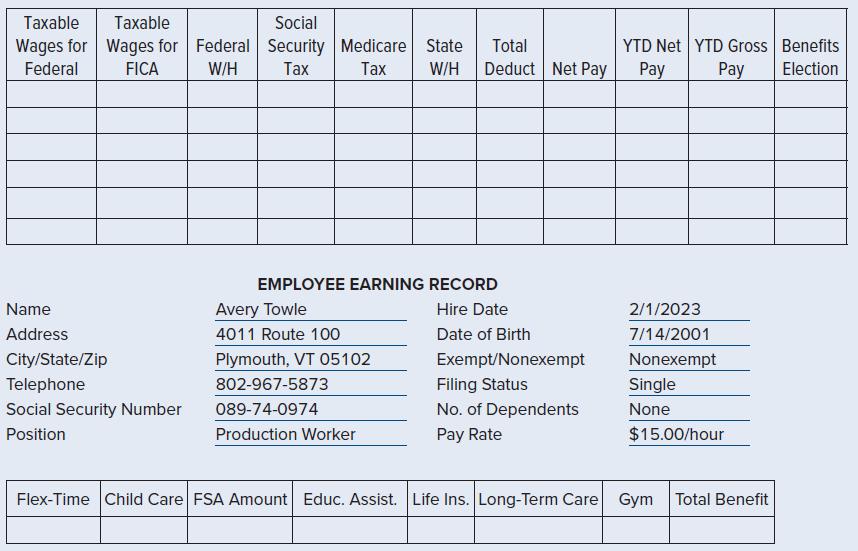

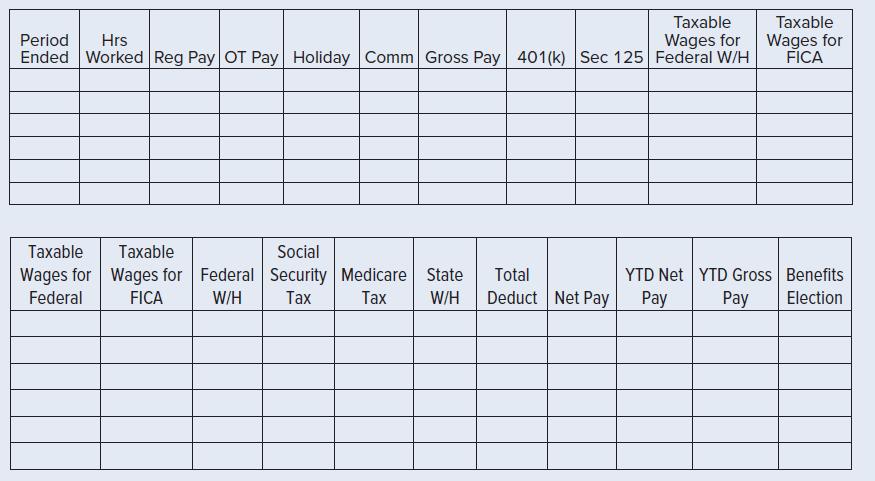

5.5 For the February 10, 2023, pay period, use the gross pay totals from the end of Chapter 3 to compute each employee’s net pay. Once you have computed the net pay (use the wage-bracket tables in Appendix C), the state withholding tax for Vermont is computed at 3.35 percent of taxable wages (i.e., gross pay less pre-tax deductions). Note that the first pay period comprises only eight days of work during the February 10 pay period. The federal income tax should be determined using the biweekly tables in Appendix C.

Initial pre-tax deductions for each employee are as follows:

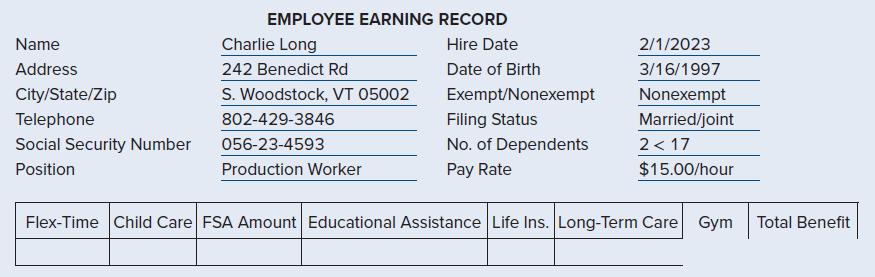

Name Deduction Millen Insurance: $155/paycheck/401(k): 3% of gross pay Towle Insurance: $100/paycheck/401(k): 5% of gross pay Long Insurance: $155/paycheck/401(k): 2% of gross pay Shangraw Insurance: $100/paycheck/401(k): 3% of gross pay Lewis Insurance: $155/paycheck/401(k): 4% of gross pay Schwartz Insurance: $100/paycheck/401(k): 5% of gross pay Prevosti Insurance: $155/paycheck/401(k): 6% of gross pay You Insurance: $100/paycheck/401(k): 2% of gross pay February 10 is the end of the first pay period and includes work completed during February 1–10. Compute the net pay for the February 10 pay period using the payroll register. All insurance and 401(k) deductions are pre-tax for federal and state. Update the Employee Earnings Records as of February 10, 2023. Joel Schwartz has made $5,000 in case sales at a 3 percent commission rate during this pay period. Recall that this is not a complete two-week pay period.

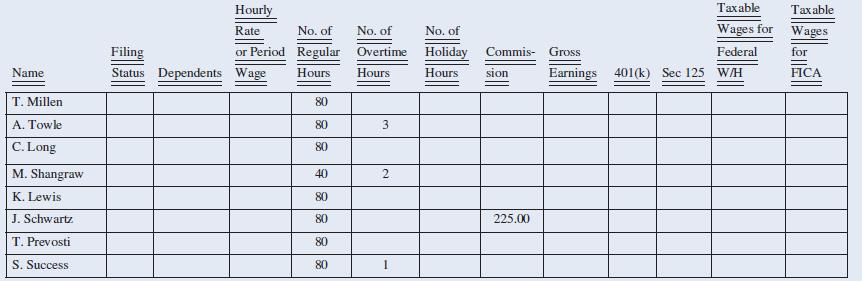

February 24, 2023, is the end of the final pay period for the month. Schwartz has sold $7,500 of products during this pay period at a 3 percent commission. Complete the payroll register for the period’s gross pay. Pay will be disbursed on February 28, 2023, and check numbers will continue from the prior payroll.

Step by Step Answer:

Payroll Accounting 2024

ISBN: 9781266832352

10th International Edition

Authors: Jeanette Landin, Paulette Schirmer