As the accountant for Runson Moving Company, you are preparing the companys annual return, Form 940 and

Question:

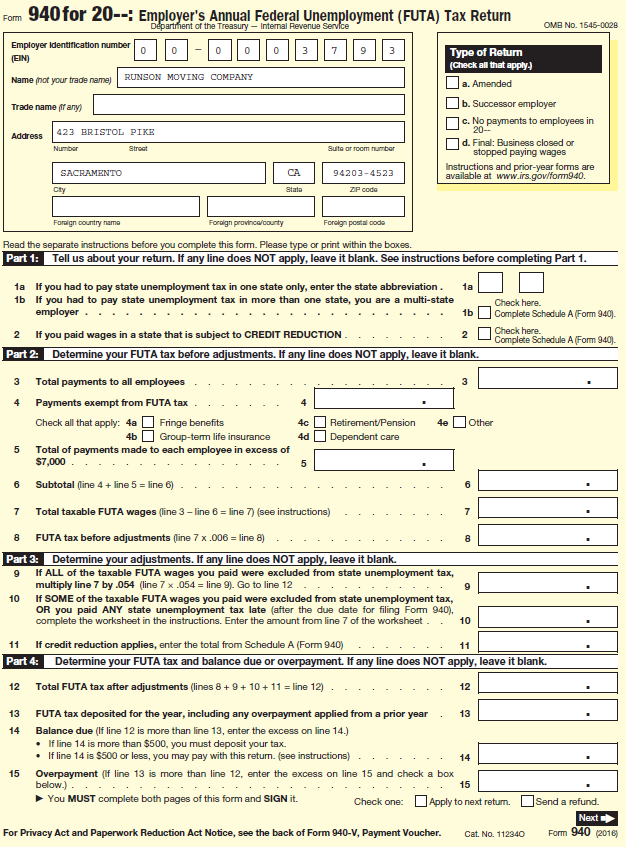

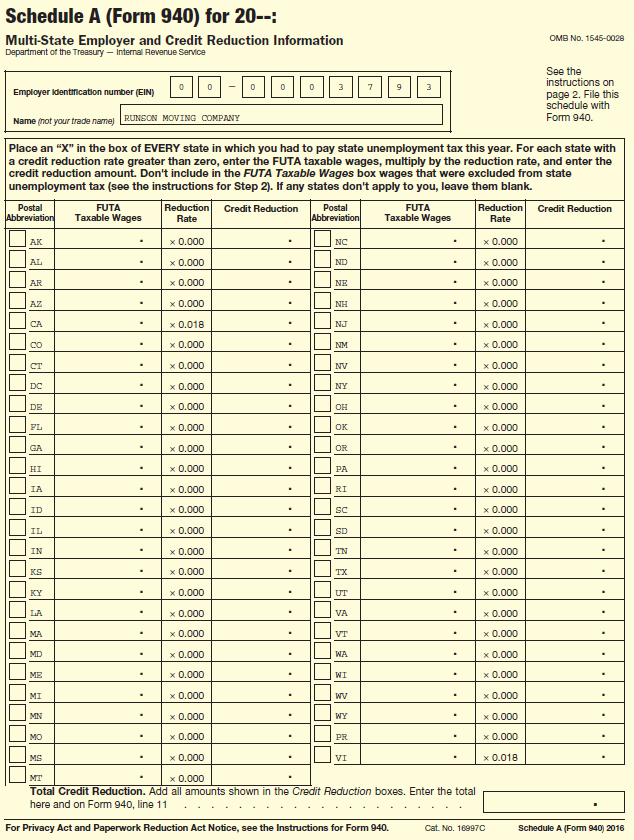

As the accountant for Runson Moving Company, you are preparing the company’s annual return, Form 940 and Schedule A. Use the following information to complete Form 940 and Schedule A on pages 5-40 to 5-42.

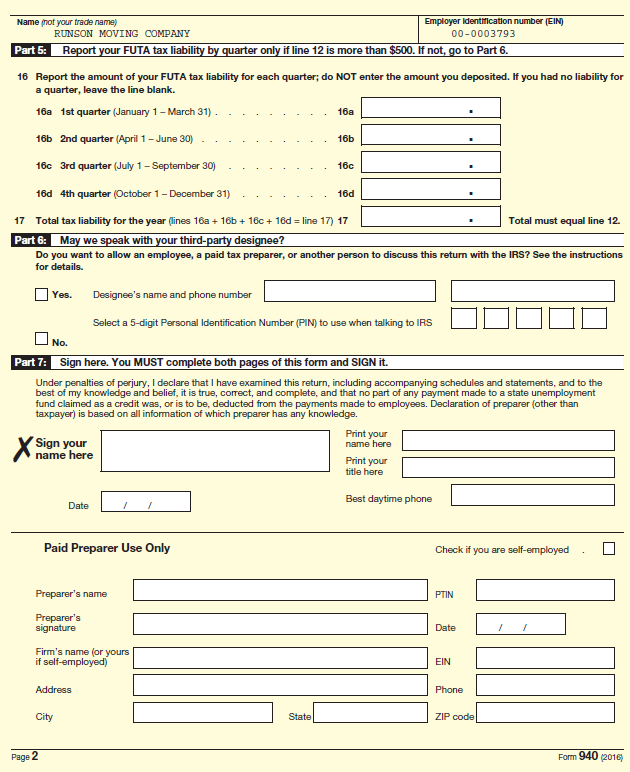

The net FUTA tax liability for each quarter of 2018 was as follows: 1st, $220.10; 2nd, $107.60; 3rd, $101.00; and 4th, $56.10 plus the credit reduction.

The net FUTA tax liability for each quarter of 2018 was as follows: 1st, $220.10; 2nd, $107.60; 3rd, $101.00; and 4th, $56.10 plus the credit reduction.

Since the net FUTA tax liability did not exceed $500 until the 4th quarter, the company was required to make its first deposit of FUTA taxes on January 31, 2019. Assume that the electronic payment was made on time.

a. One of the employees performs all of his duties in another state—Arizona.

b. Total payments made to employees during calendar year 2018:

California.................................... $102,310

Arizona....................................... 18,490

Total........................................... $120,800

c. Employer contributions in California into employees’ 401(k) retirement plan: $3,500.

d. Payments made to employees in excess of $7,000: $36,500 ($11,490 from Arizona and $25,010 from California).

e. Form is to be signed by Mickey Vixon, Vice President.

f. Phone number—(219) 555-8310.

Form 940 for 20-: Employer's Annual Federal Unemployment (FUTA) Tax Return Departhent of the Treasury - Internal Revenue Service OMB No. 1545-0028 Employer Identification number Type of Return (Check all that apply) (EIN) RUNSON MOVING COMPANY Name (not your trade name) Da. Amended b. Successor employer Trade name ff any) c. No payments to employees in 20- 423 BRISTOL PIKE Address d. Final: Business closed or stopped paying wages Sute or room number Numbor Stroet Instructions and prior-year forms are available at www.irs.gov/form940. SACRAMENTO CA 94203-4523 Cty State ZP code Foraign country nama Foraign provinca/county Foroign postal codo Read the separate instructions before you complete this form. Please type or print within the boxes. Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1. If you had to pay state unemployment tax in one state only, enter the state abbreviation. 1a 1a 1b If you had to pay state unemployment tax in more than one state, you are a multi-state employer . Check here. 1b Complete Schedule A (Form 940). 2 If you paid wages in a state that is subject to CREDIT REDUCTION . Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank. Check here. Complete Schedule A (Form 940). 3 Total payments to all employees 3 4 Payments exempt from FUTA tax Check all that apply: 4a Fringe benefits 4c Retirement/Pension Other 4b O Group-tem life insurance 4d Dependent care Total of payments made to each employee in excess of $7,000 . Subtotal (line 4+ line 5 = line 6). Total taxable FUTA wages (line 3 - line 6 = line 7) (see instructions) FUTA tax before adjustments (line 7 x.006 = line 8) Part 3: Detemine your adjustments. If any line does NOT apply, leave it blank. If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by .054 (line 7 x.054 = line 9). Go to line 12 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for filing Form 940), 10 10 complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet. If credit reduction applies, enter the total from Schedule A (Form 940) 11 11 Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. Part 4: Total FUTA tax after adjustments (lines 8 + 9+ 10+11 = line 12) 12 12 . 13 FUTA tax deposited for the year, including any overpayment applied from a prior year 13 14 Balance due (If line 12 is more than line 13, enter the excess on line 14.) • If line 14 is more than $500, you must deposit your tax. • I ine 14 is $500 or less, you may pay with this retum. (see instructions) 14 . 15 Overpayment (If line 13 is more than line 12, enter the excess on line 15 and check a box below.). You MUST complete both pages of this form and SIGN it. 15 LApply to next return. Check one: |Send a refund. Next Form 940 (2016) For Privacy Act and Paperwork Reduction Act Notice, see the back of Form 940-V, Payment Voucher. Cat. No. 112340 Name not your trade name) Employer identfication number (EIN) RUNSON MOVING COMPANY 00-0003793 Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6. 16 Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 16a 1st quarter (January 1- March 31) . 16a 16b 2nd quarter (April 1-June 30) 16b 16c 3rd quarter (July 1- September 30) 16c 16d 4th quarter (October 1- December 31) 16d 17 Total tax liability for the year (lines 16a + 16b + 16c + 16d = line 17) 17 Total must equal line 12. Part 6: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details. Yes. Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS No. Part 7: Sign here. You MUST complete both pages of this form and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Print your name here Sign your name here Print your title here Best daytime phone Date Paid Preparer Use Only Check if you are self-employed Preparer's name PTIN Preparer's signature Date Firm's name (or yours if self-employed) EIN Address Phone City State ZIP code Page Form 940 (2016)

Step by Step Answer:

Form 940 California wages 102310 3500 Retirement Plan 25010 in excess of 7000 73800 0018 102310 3500 Retirement Plan 25010 payments in excess of 7000 Form 940 for 20 Employers Annual Federal Unemploym...View the full answer

Students also viewed these Business questions

-

The information listed below refers to the employees of Lemonica Company for the year ended December 31, 2018. The wages are separated into the quarters in which they were paid to the individual...

-

Magda is an artist. She entered into a contract with Karl under which she gave Karl the authority, for six months, to try to find a buyer for one of her paintings. After three months, Karl had not...

-

Describe and differentiate between the costs associated with renting or buying a home.

-

Assume electricity is generated by three technologies: a base load technology with cost function C b (x b ) and proportional emission coefficient b ; gas turbines with cost function C g (x g ) and...

-

(a) How many permutations of size 3 can one produce with the letters m, r, a, f, and t? (b) List all the combinations of size 3 that result for the letters m, r, a, f, and t.

-

Solve the given problems. Refer to Example 4. If E = 85 + 74j volts and Z = 2500 1200j ohms, find the complex-number representation for I. Data from Example 4 In an alternating-current circuit, the...

-

Bergamo Bays computer system generated the following trial balance on December 31, 2019. The companys manager knows something is wrong with the trial balance because it does not show any balance for...

-

On May 10, First Lift Corporation, a wholesaler of hydraulic lifts, acquired land in exchange for 3,600 shares of $4 par common stock with a current market price of $28. Journalize the entry to...

-

Schedule I, II and III banks offer essentially the same services. Select one: True False

-

Saira Morrow is the sole owner of Buena Vista Park, a public camping ground near the Crater Lake National Recreation Area. Saira has compiled the following financial information as of December 31,...

-

You have a business leasing photocopiers. You are negotiating a contract with Zoltan, who is acting on behalf of Bridgeworks Manufacturing Inc. You have visited Zoltan at the offices of Bridgeworks...

-

Tatiana was looking for a BMW to lease. She went to Reston Sales and Leasing Inc and met with Joe Reston, the manager and sole owner of the business. After some discussion, Reston said he could...

-

Soles Ltd sells two types of shoes, sandals and sneakers. During the financial year ended 30 June 2025, fixed costs were \($230\) 400 and sales were in the ratio of three units (pairs) of sandals to...

-

The Role of Leadership in Shaping Organizational Culture Recent research stated that [c]ompanies with an established organizational culture that includes strong capabilities for change, commitment to...

-

Unscheduled absences by clerical and production workers are an important cost in many companies. Reducing the rate of absenteeism is, therefore, an important goal for a company's human relations...

-

Many of the largest tech firms, including Google, Apple, Amazon, and Microsoft, have spent hundreds of millions of dollars to improve their information technology infrastructure. Now, these companies...

-

In the business sense, a product refers to a commodity available for purchase, encompassing both services and tangible or intangible items. It may exist in physical, virtual, or cyber forms. Every...

-

Data Exploration and Multiple Linear Regression (MLR) using SAS. The "College" data set contains the statistics for many US Colleges from 1995 issue of US News and World Report. It has 777...

-

For the following exercises, use the properties of logarithms to expand each logarithm as much as possible. Rewrite each expression as a sum, difference, or product of logs. log(x y 4)

-

Define a traverse in Surveying?

-

The partnership of Keenan and Kludlow paid the following wages during this year: M. Keenan (partner) ................................. $85,000 S. Kludlow (partner) ....................................

-

During 2016, Shoupe Company was subject to the New Jersey state unemployment tax of 5.1%. The company's taxable wages for FUTA were $93,400 and for SUTA, $194,300. Compute: a. SUTA tax that Shoupe...

-

As of June 30, 2015 (the computation date for the 2016 tax rate), Amanda Company had a negative balance of $1,015 in its unemployment reserve account in State A. The company's average payroll over...

-

Product Weight Sales Additional Processing Costs P 300,000 lbs. $ 245,000 $ 200,000 Q 100,000 lbs. 30,000 -0- R 100,000 lbs. 175,000 100,000 If joint costs are allocated based on relative weight of...

-

The projected benefit obligation was $380 million at the beginning of the year. Service cost for the year was $21 million. At the end of the year, pension benefits paid by the trustee were $17...

-

CVP Modeling project The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on...

Study smarter with the SolutionInn App