During 2018, Matti Conner, president of Maggert Company, was paid a semimonthly salary of $5,800. Compute the

Question:

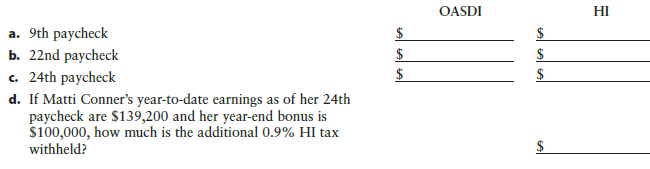

During 2018, Matti Conner, president of Maggert Company, was paid a semimonthly salary of $5,800. Compute the amount of FICA taxes that should be withheld from her:

Transcribed Image Text:

OASDI HI a. 9th paycheck b. 22nd paycheck c. 24th paycheck d. If Matti Conner's year-to-date earnings as of her 24th paycheck are $139,200 and her year-end bonus is $100,000, how much is the additional 0.9% HI tax withheld? re

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

a 9th paycheck b 22nd paycheck 127200 5800 x ...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

During 2013, Matti Conners, president of Maggert Company, was paid a semimonthly salary of $5,200. Compute the amount of FICA taxes that should be withheld fromher: OASDI HI a. 9th paycheck S b. 22nd...

-

During 2016, Matti Conners, president of Maggert Company, was paid a semimonthly salary of $5,500. Compute the amount of FICA taxes that should be withheld from her: OASDI HI a. 9th paycheck b. 22nd...

-

During 2017, Matti Conners, president of Maggert Company, was paid a semimonthly salary of $5,500. Compute the amount of FICA taxes that should be withheld from her: HI OASDI a. 9th paycheck b. 22nd...

-

IFRS requires the following: (a) Ending inventory is written up and down to net realizable value each reporting period. (b) Ending inventory is written down to net realizable value but cannot be...

-

Rewrite each of the following statements as an implication in the if-then form. (a) Practicing her serve daily is a sufficient condition for Darci to have a good chance of winning the tennis...

-

Find the exact sum of the positive roots of x 2 2x 2 = 0 and x 2 + 2x 11 = 0.

-

Scott has just received the latest figures from his market research agency regarding last years overall market position. He is pleased as this is the third year that the company in which he is...

-

During May, Joliet Fabrics Corporation manufactured 500 units of a special multilayer fabric with the trade name Stylex. The following information from the Stylex production department also pertains...

-

In the following problem, suppose that the price on the day of the sale is considered the market price, not the net price. 3) Find the annual rate of return, compounded per semester, on an unsecured...

-

Provo Clothing purchased land, paying $ 80,000 cash plus a $ 220,000 note payable. In addition, Provo paid delinquent property tax of $ 1,500, title insurance costing $ 800, and $ 4,000 to level the...

-

All facts about this NFPO are identical to those described in Problem 11, except that the deferral method of recording contributions is used for accounting and for external financial reporting. Fund...

-

Eric Sherm began working as a part-time waiter on April 2, 2018, at Yardville Restaurant. The cash tips of $475 that he received during April were reported on Form 4070, which he submitted to his...

-

A continuous band pass channel can be modeled as illustrated in Figure 12.46. Assuming a signal power of 60 W and a noise power spectral density of 10 -5 W/Hz, plot the capacity of the channel as a...

-

What are factors which hamper the promotion of an entrepreneurial culture in South Africa?

-

Please Help P/R End Date 2/8/2019 Company Name: Prevosti Farms and Sugarhouse Check Date 2/13/2019 Tax Name M/S # of W/H Hourly Rate or Period # of Regular # of Overtime # of Holiday Wage Hours Hours...

-

Read the description of following adjustments that are required at the end of the accounting period for Hubbard Repair Services, a new firm. Determine the account and amount to be debited and the...

-

Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by; over twenty-four years...

-

Here are summary statistics for randomly selected weights of newborn girls: n = 36, x = 3180.6 g, s = 700.5 g. Use a confidence level of 99% to complete parts (a) through (d) below. a. Identify the...

-

How can the logarithmic equation log b x = y be solved for x using the properties of exponents?

-

How does the organizational structure of an MNC influence its strategy implementation?

-

Which act sets the minimum wage, and what is the current wage rate?

-

Under the FLSA, what information concerning employees' wages earned must be maintained by the employer?

-

Who pays the social security taxes that are levied by the Federal Insurance Contributions Act?

-

American Food Services, Incorporated leased a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1 , 2 0 2 4 . The lease...

-

Which of the following statements is true? Financial measures tend to be lag indicators that report on the results of past actions. LA profit center is responsible for generating revenue, but it is...

-

Andretti Company has a single product called a Dak. The company normally produces and sells 8 0 , 0 0 0 Daks each year at a selling price of $ 5 6 per unit. The company s unit costs at this level of...

Study smarter with the SolutionInn App