LO 5-1, 5-2, 5-3, 5-4, 5-5 You are the payroll accountant for Multi Winds Energy of Cornelius,

Question:

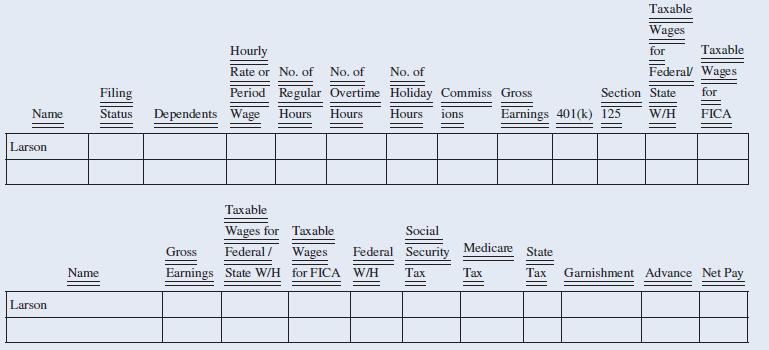

LO 5-1, 5-2, 5-3, 5-4, 5-5 You are the payroll accountant for Multi Winds Energy of Cornelius, North Carolina, whose employees are paid biweekly. An employee, Larson, comes to you on September 14 and requests a pay advance of $1,000, which will be paid back in equal parts on the September 22 and October 20 paychecks. Larson is single, has no dependents, is paid $52,500 per year, contributes 5 percent of gross pay to a 401(k) plan, and has $250 per paycheck deducted for a court-ordered garnishment. Compute the net pay for Larson’s September 24 paycheck. The state income tax rate is 4.75 percent.

Use the wage-bracket tables in Appendix C to determine the federal income tax withholding amount. You do not need to complete the number of hours. Assume that no pre-tax deductions exist for the employee and box 2 is not checked.

Step by Step Answer:

Payroll Accounting 2024

ISBN: 9781266832352

10th International Edition

Authors: Jeanette Landin, Paulette Schirmer