LO 5-1, 5-2, 5-3, 5-5 Enlightened Eats in Anchorage, Alaska, has six employees who are paid semimonthly.

Question:

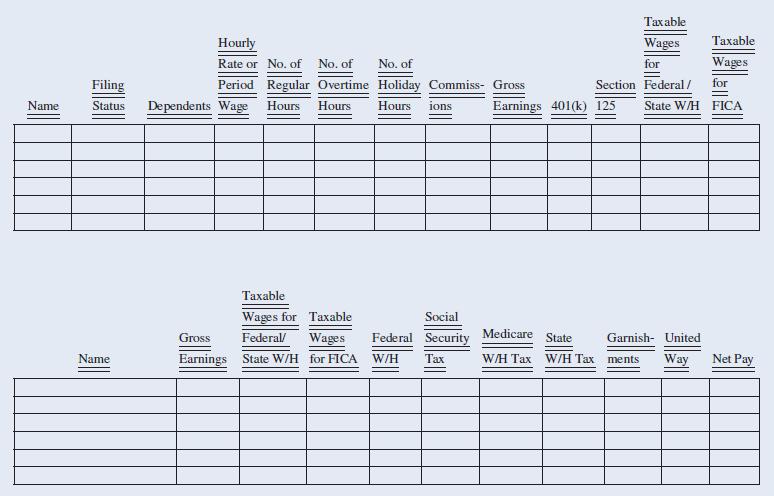

LO 5-1, 5-2, 5-3, 5-5 Enlightened Eats in Anchorage, Alaska, has six employees who are paid semimonthly. Calculate the net pay from the information provided here for the November 15 pay date. Assume that all wages are subject to Social Security and Medicare taxes. All 401(k) and Section 125 amounts are pretax deductions. Use the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to compute federal income taxes. You do not need to complete the number of hours.

a. W. Packer Married/Joint, two dependents

b. K. Ela Married/Separate, two dependents

c. G. Laureano Single, no dependents, box 2 not checked Annual pay: $50,400 Section 125 deduction: $75 per pay period 401(k) deduction: $50 per pay period

d. T. Spraggins Married/joint, one dependent

e. M. Christman Single, two dependents

f. J. Cherry Married/joint, one other dependent, box 2 checked Annual pay: $48,400 401(k) deduction: $75 per pay period

Step by Step Answer:

Payroll Accounting 2024

ISBN: 9781266832352

10th International Edition

Authors: Jeanette Landin, Paulette Schirmer