Question:

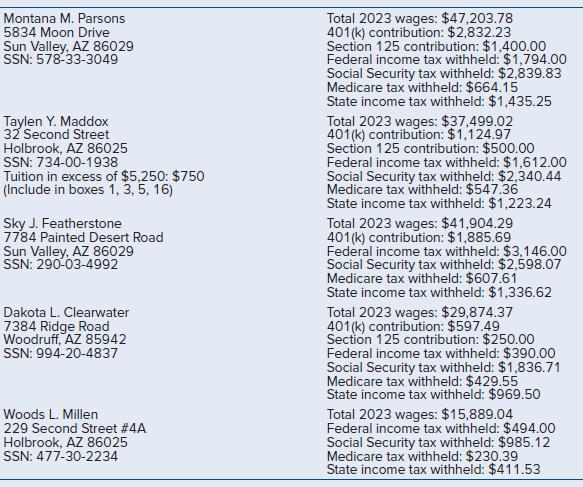

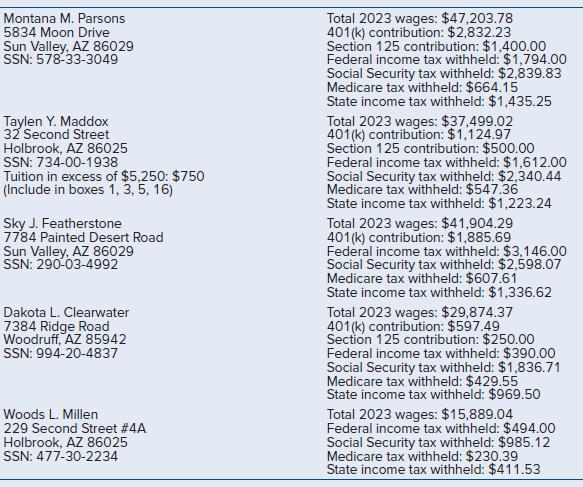

LO 6-3 Reese Castor, the owner of Castor Corporation, is located at 1310 Garrick Way, Sun Valley, Arizona, 86029, phone number is 928-555-8842. The federal EIN is 20-1948348, and the state employer identification number is 9040-

2038-1. Prepare the Form W-2 for each of the following employees of Castor Corporation as of December 31, 2023. The same deductions are allowed for state income tax as for federal. The form was submitted on January 12, 2024.

Transcribed Image Text:

Montana M. Parsons 5834 Moon Drive Sun Valley, AZ 86029 SSN: 578-33-3049 Taylen Y. Maddox 32 Second Street Holbrook, AZ 86025 SSN: 734-00-1938 Tuition in excess of $5,250: $750 (Include in boxes 1, 3, 5, 16) Sky J. Featherstone 7784 Painted Desert Road Sun Valley, AZ 86029 SSN: 290-03-4992 Dakota L. Clearwater 7384 Ridge Road Woodruff, AZ 85942 SSN: 994-20-4837 Woods L. Millen 229 Second Street #4A Holbrook, AZ 86025 SSN: 477-30-2234 Total 2023 wages: $47,203.78 401(k) contribution: $2,832.23 Section 125 contribution: $1,400.00 Federal income tax withheld: $1,794.00 Social Security tax withheld: $2,839.83 Medicare tax withheld: $664.15 State income tax withheld: $1,435.25 Total 2023 wages: $37,499.02 401(k) contribution: $1,124.97 Section 125 contribution: $500.00 Federal income tax withheld: $1,612.00 Social Security tax withheld: $2,340.44 Medicare tax withheld: $547.36 State income tax withheld: $1,223.24 Total 2023 wages: $41,904.29 401(k) contribution: $1,885.69 Federal income tax withheld: $3,146.00 Social Security tax withheld: $2,598.07 Medicare tax withheld: $607.61 State income tax withheld: $1,336.62 Total 2023 wages: $29,874.37 401(k) contribution: $597.49 Section 125 contribution: $250.00 Federal income tax withheld: $390.00 Social Security tax withheld: $1,836.71 Medicare tax withheld: $429.55 State income tax withheld: $969.50 Total 2023 wages: $15,889.04 Federal income tax withheld: $494.00 Social Security tax withheld: $985.12 Medicare tax withheld: $230.39 State income tax withheld: $411.53