Question:

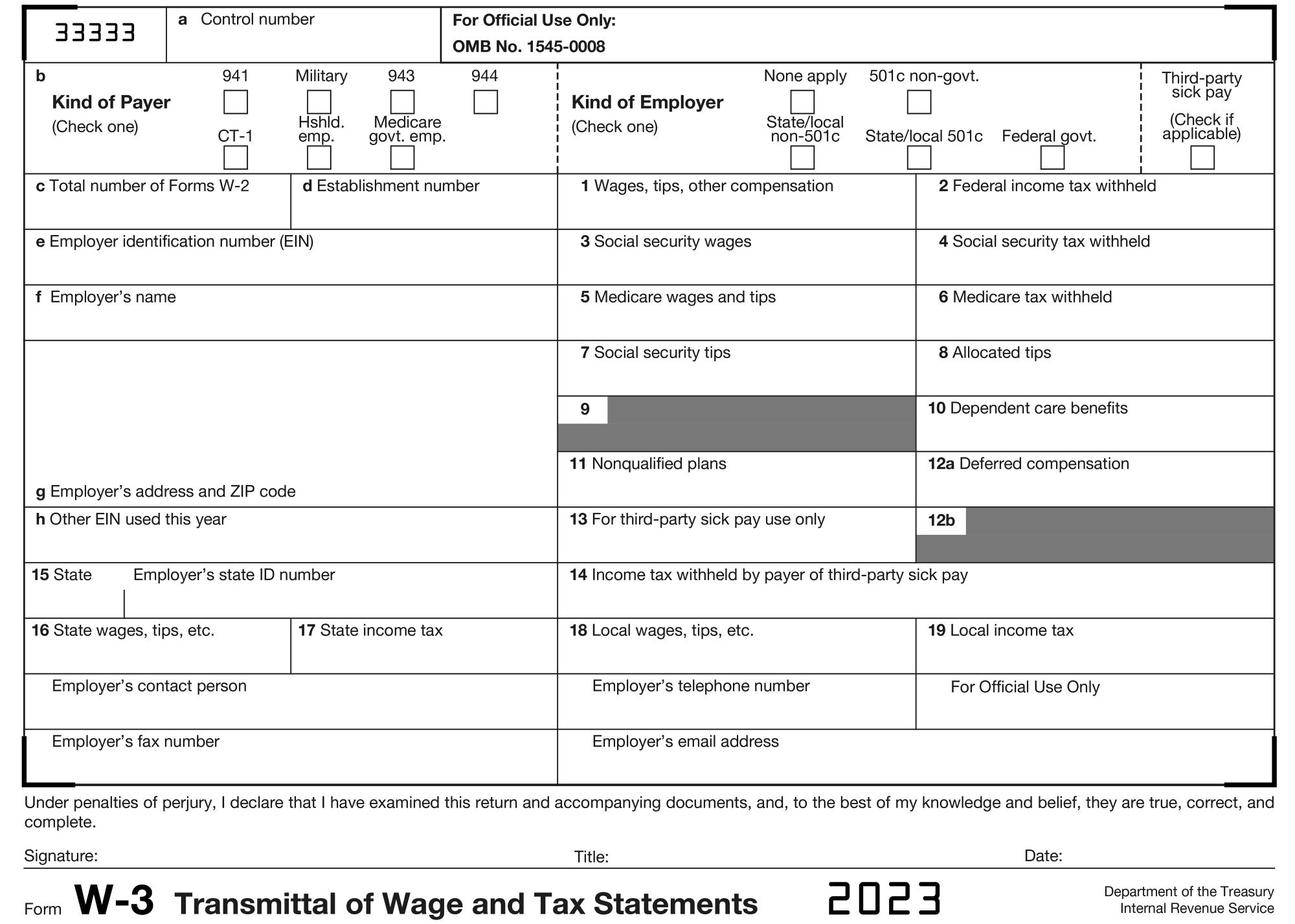

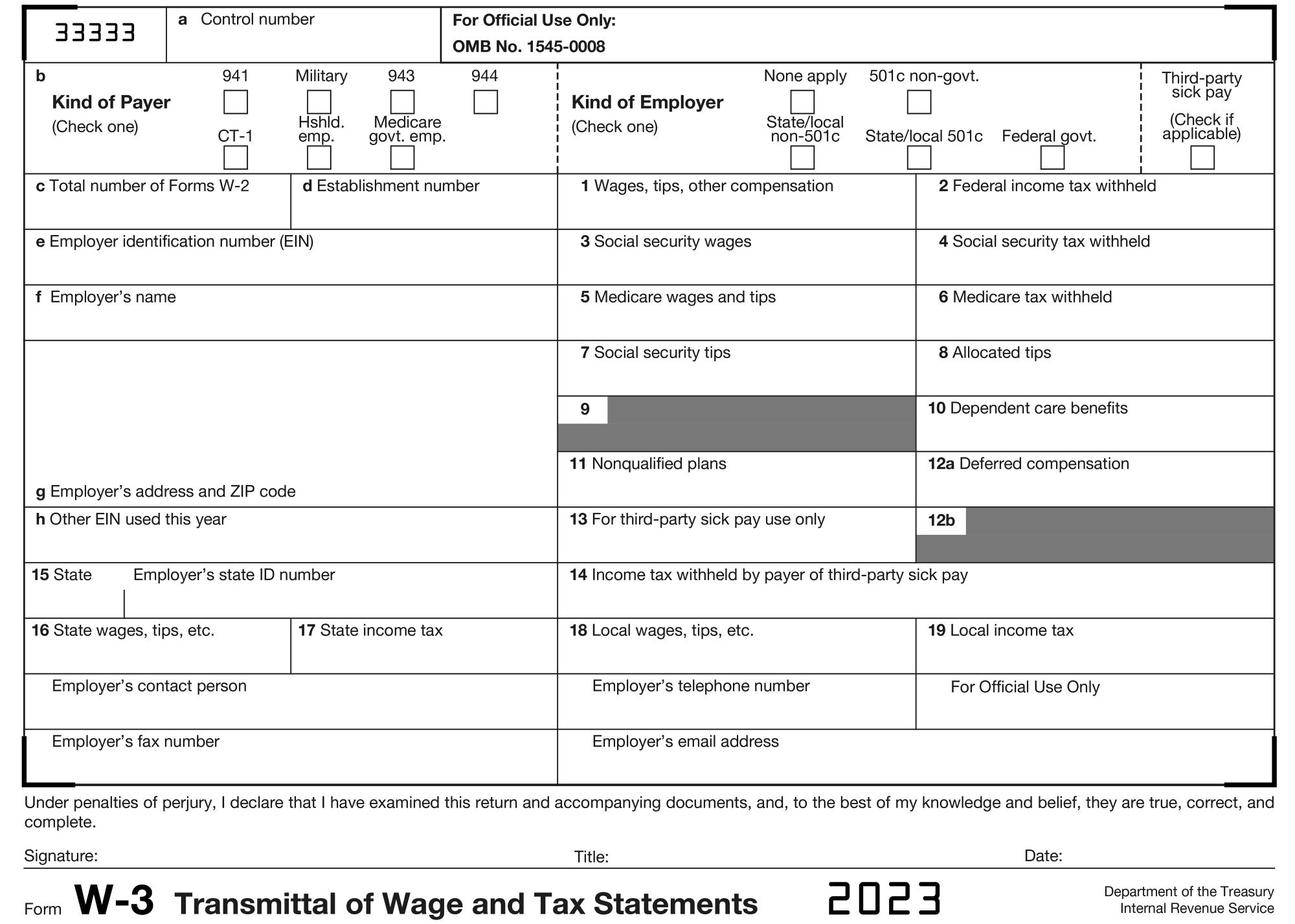

LO 6-3 Using the information from P6-10A for Leda, Inc., completed Form W-3 must accompany the company’s W-2 forms. Leda, Inc., is a 941 payer and is a private, for-profit company. Kieran Leda is the owner; the phone number is 207-555-1212; no email address to disclose; the fax number is 207-

555-9898. No third-party sick pay was applied for 2023. The form was signed on January 19, 2024.

Transcribed Image Text:

a Control number 33333 For Official Use Only: OMB No. 1545-0008 b 941 Military 943 944 I None apply 501c non-govt. Kind of Payer (Check one) CT-1 Hshld. emp. Medicare govt. emp. Kind of Employer (Check one) State/local non-501c State/local 501c Federal govt. c Total number of Forms W-2 d Establishment number 1 Wages, tips, other compensation 2 Federal income tax withheld Third-party sick pay (Check if applicable) 3 Social security wages 4 Social security tax withheld e Employer identification number (EIN) f Employer's name g Employer's address and ZIP code h Other EIN used this year 5 Medicare wages and tips 7 Social security tips 9 6 Medicare tax withheld 8 Allocated tips 10 Dependent care benefits 12a Deferred compensation 11 Nonqualified plans 13 For third-party sick pay use only 12b 14 Income tax withheld by payer of third-party sick pay 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. Employer's contact person Employer's fax number Employer's telephone number Employer's email address 19 Local income tax For Official Use Only Under penalties of perjury, I declare that I have examined this return and accompanying documents, and, to the best of my knowledge and belief, they are true, correct, and complete. Signature: Form Title: W-3 Transmittal of Wage and Tax Statements 2023 Date: Department of the Treasury Internal Revenue Service