Question:

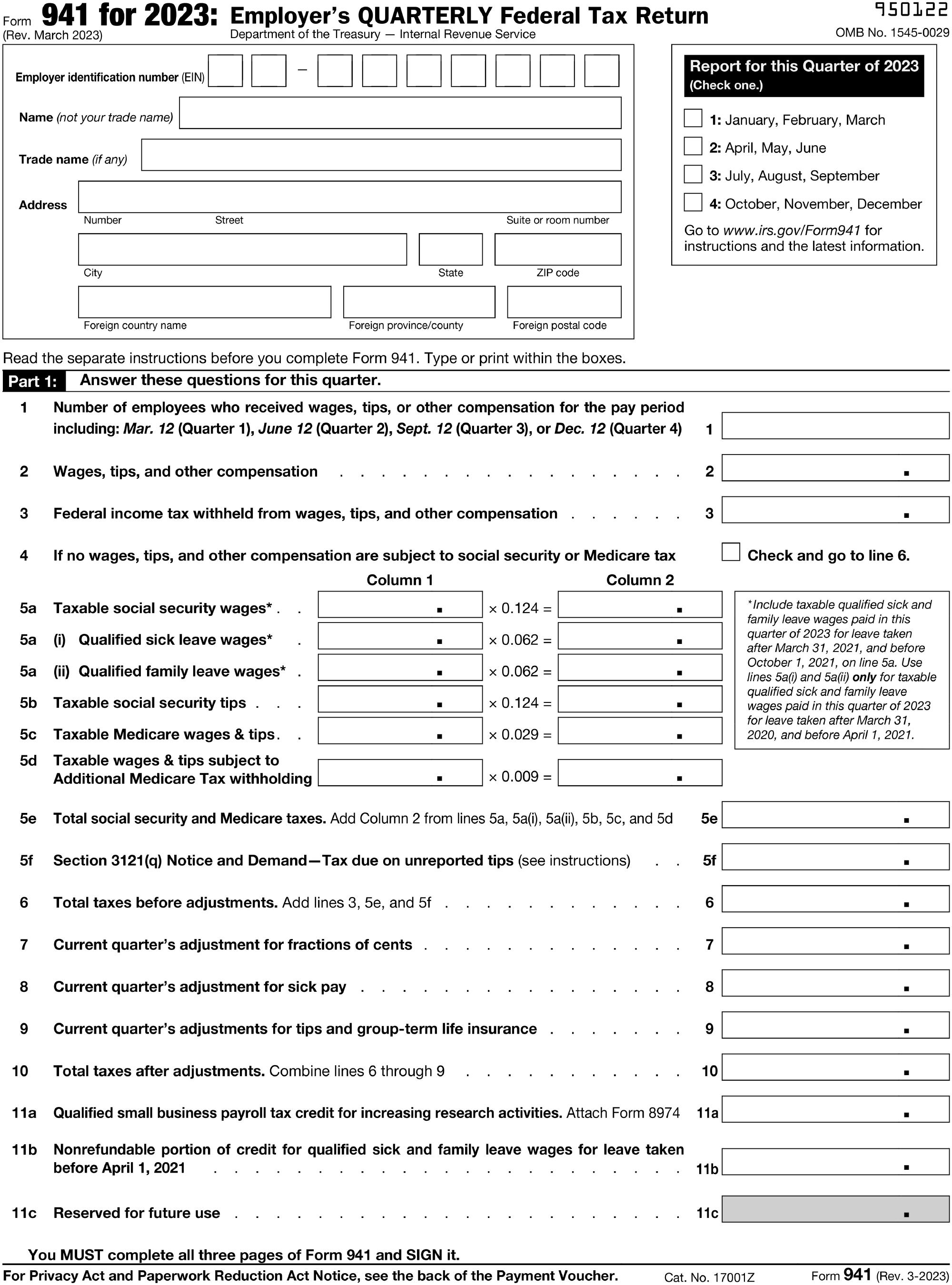

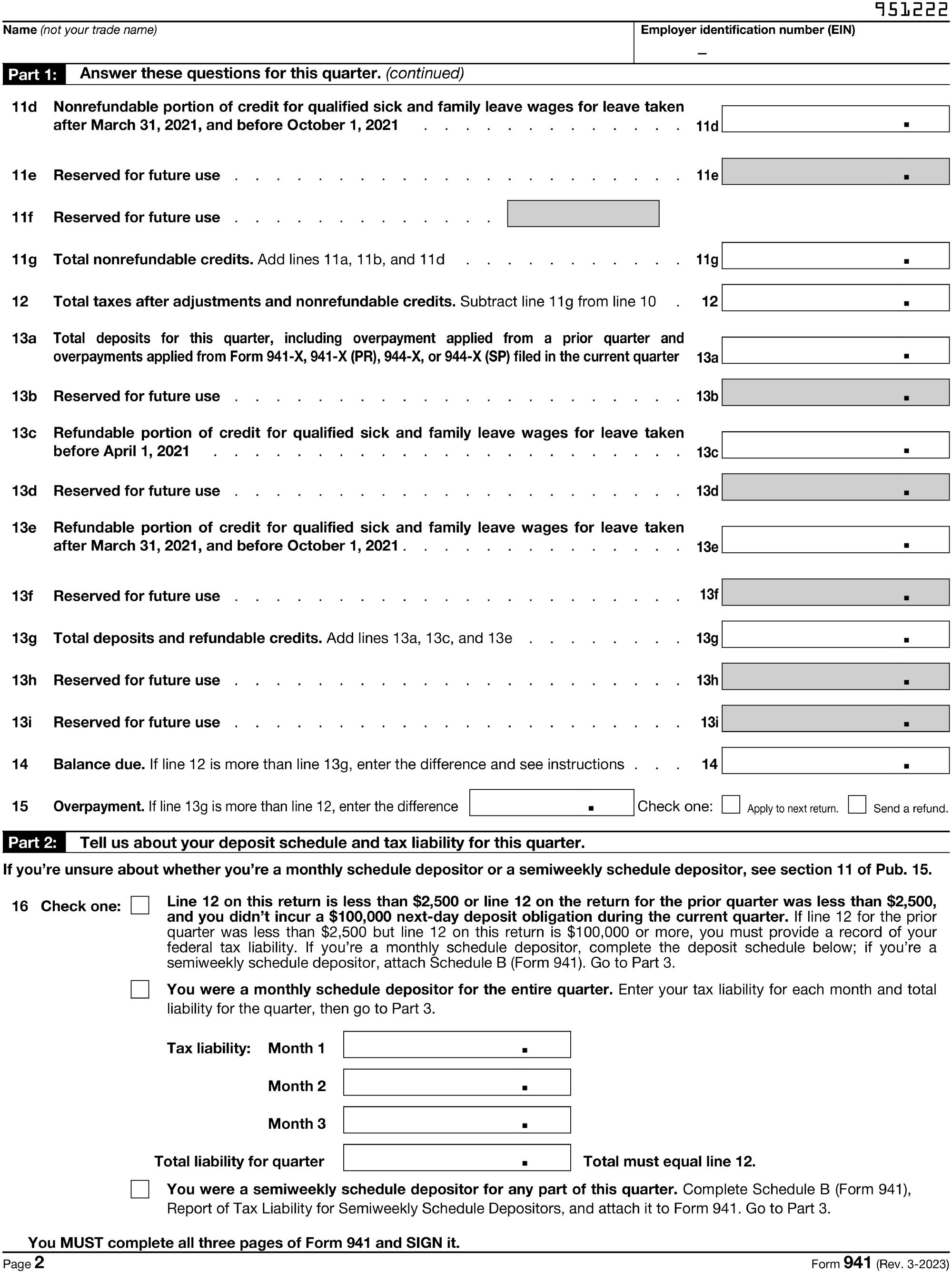

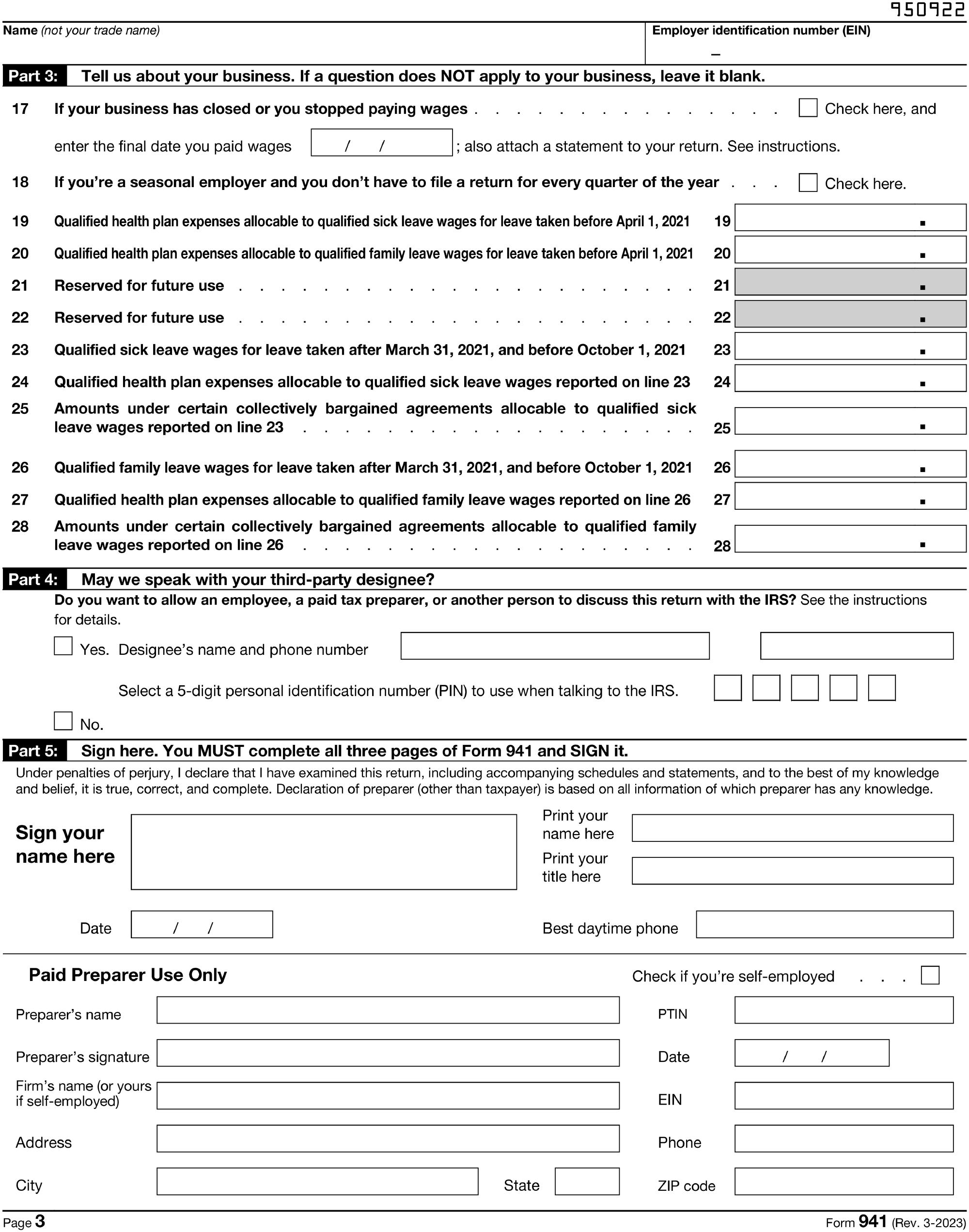

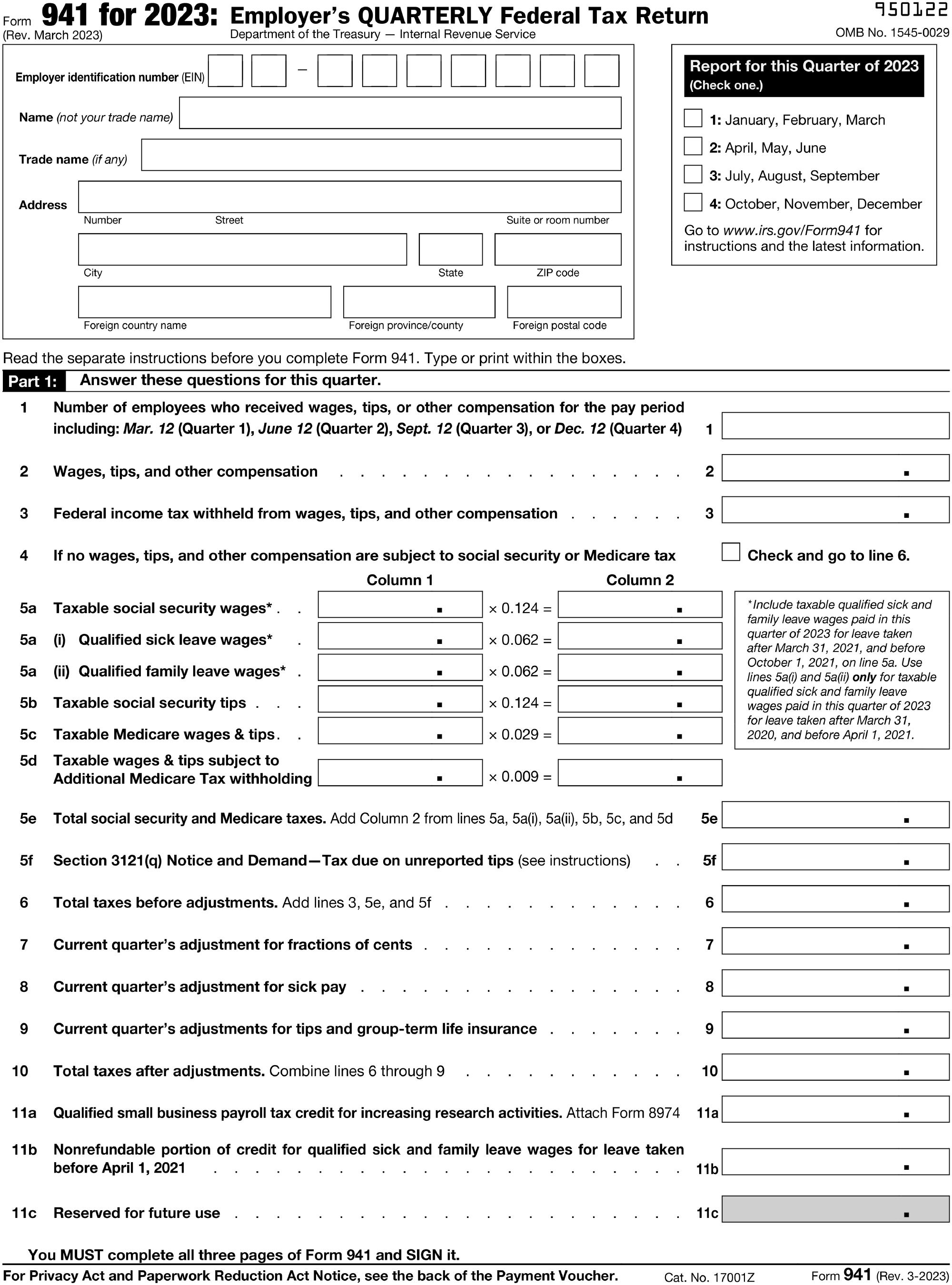

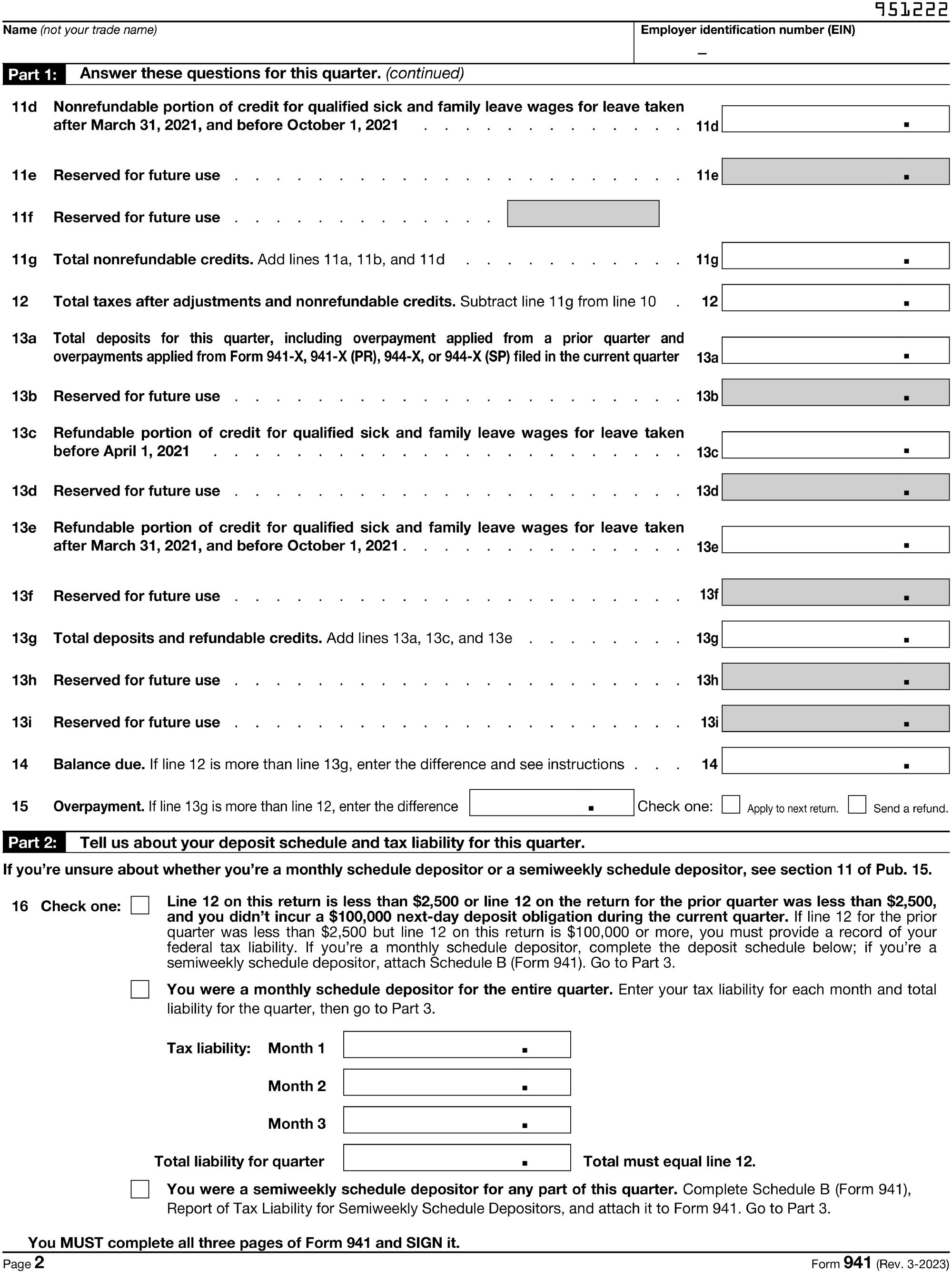

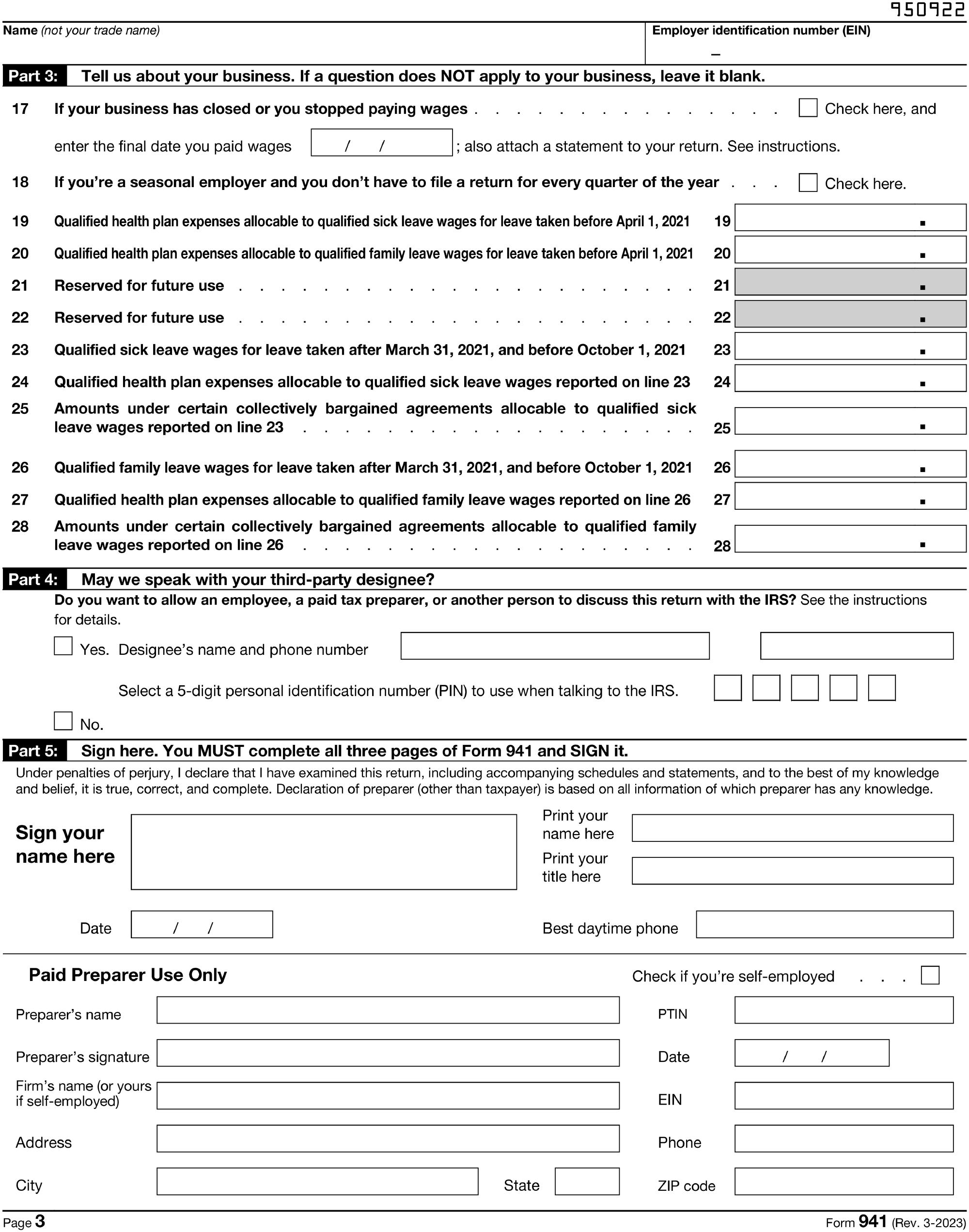

LO 6-3 Using the information from P6-6B, complete the following form 941 for the first quarter of 2023. The form was signed by the owner on April 11, 2023.

EIN: 98-0050036 Address: 1021 Old Plainfield Road, Salina, California, 95670 Phone: 707-555-0303 Number of employees: 8 Wages, tips, and other compensation paid during the first quarter of 2023:

$302,374 Social Security taxable wages: $280,000 Medicare taxable wages: $280,000 Income tax withheld: $51,000 Monthly tax liability:

January $31,280.00 February 31,280.00 March 31,280.00

Transcribed Image Text:

Form 941 for 2023: Employer's QUARTERLY Federal Tax Return (Rev. March 2023) Employer identification number (EIN) Name (not your trade name) Trade name (if any) Department of the Treasury Internal Revenue Service Address Number Street - Suite or room number 950122 OMB No. 1545-0029 Report for this Quarter of 2023 (Check one.) 1: January, February, March 2: April, May, June 3: July, August, September 4: October, November, December Go to www.irs.gov/Form941 for instructions and the latest information. City Foreign country name State ZIP code Foreign province/county Foreign postal code Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 Number of employees who received wages, tips, or other compensation for the pay period including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 1 2 Wages, tips, and other compensation 2 3 Federal income tax withheld from wages, tips, and other compensation 3 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Check and go to line 6. Column 2 5a Taxable social security wages* . 0.124 = 5a (i) Qualified sick leave wages* 0.062 = 5a (ii) Qualified family leave wages* 5b Taxable social security tips . 0.062 = x 0.124 = 5c Taxable Medicare wages & tips. 5d Taxable wages & tips subject to 0.029 = *Include taxable qualified sick and family leave wages paid in this quarter of 2023 for leave taken after March 31, 2021, and before October 1, 2021, on line 5a. Use lines 5a(i) and 5a(ii) only for taxable qualified sick and family leave wages paid in this quarter of 2023 for leave taken after March 31, 2020, and before April 1, 2021. Additional Medicare Tax withholding 0.009 5e Total social security and Medicare taxes. Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d 5e 5f Section 3121(q) Notice and Demand-Tax due on unreported tips (see instructions) 5f 6 Total taxes before adjustments. Add lines 3, 5e, and 5f 6 7 Current quarter's adjustment for fractions of cents 7 8 Current quarter's adjustment for sick pay 8 9 Current quarter's adjustments for tips and group-term life insurance 9 10 Total taxes after adjustments. Combine lines 6 through 9 10 11a Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11a 11b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021 11b 11c Reserved for future use 11c You MUST complete all three pages of Form 941 and SIGN it. For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Cat. No. 17001Z Form 941 (Rev. 3-2023)