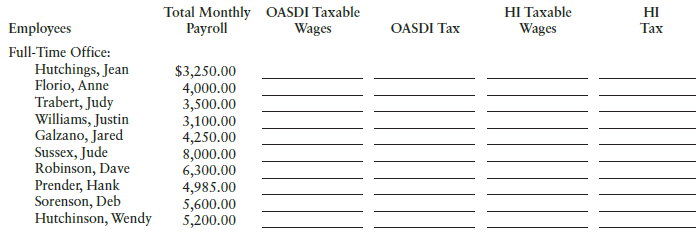

The monthly and hourly wage schedule for the employees of Quincy, Inc., follows. No employees are due

Question:

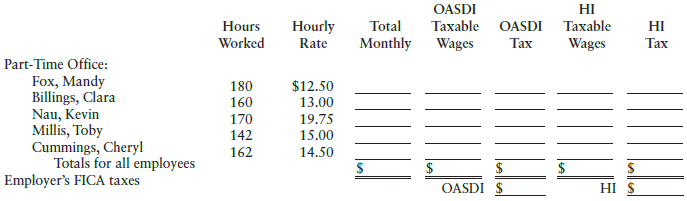

The monthly and hourly wage schedule for the employees of Quincy, Inc., follows. No employees are due overtime pay. Compute the following for the last monthly pay of the year:

a. The total wages of each part-time employee for December 2018.

b. The OASDI and HI taxable wages for each employee.

c. The FICA taxes withheld from each employee’s wages for December.

d. Totals of columns.

e. The employer’s FICA taxes for the month.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: