Christensen Ranch operates in Pennsylvania. Calculate the state income tax for each employee using the state income

Question:

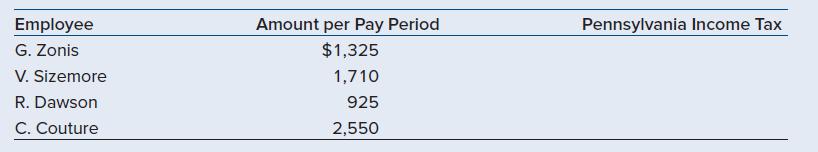

Christensen Ranch operates in Pennsylvania. Calculate the state income tax for each employee using the state income tax rate of 3.07 percent. Assume that no pre-tax deductions exist for any employee.

Transcribed Image Text:

Employee G. Zonis V. Sizemore R. Dawson C. Couture Amount per Pay Period $1,325 1,710 925 2,550 Pennsylvania Income Tax

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 52% (19 reviews)

To calculate the Pennsylvania income tax for each employee we need to mul...View the full answer

Answered By

Dulal Roy

As a tutor, I have gained extensive hands-on experience working with students one-on-one and in small group settings. I have developed the ability to effectively assess my students' strengths and weaknesses, and to customize my teaching approach to meet their individual needs.

I am proficient at breaking down complex concepts into simpler, more digestible pieces, and at using a variety of teaching methods (such as visual aids, examples, and interactive exercises) to engage my students and help them understand and retain the material.

I have also gained a lot of experience in providing feedback and guidance to my students, helping them to develop their problem-solving skills and to become more independent learners. Overall, my hands-on experience as a tutor has given me a deep understanding of how to effectively support and encourage students in their learning journey.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Christensen Ranch operates in Pennsylvania. Using the state income tax rate of 3.07%, calculate the state income tax for each employee.

-

Fannons Chocolate Factory operates in North Carolina. Calculate the state income tax for each employee using the state income tax rate of 4.99 percent. Assume that no pre-tax deductions exist for any...

-

Compute the Federal income tax withholding for each employee using the percentage method in Appendix C. Assume that no pre-tax deductions exist for any employee. (Round your intermediate calculations...

-

Preparing and interpreting a statement of cash flows using a T-account work sheet. Financial statement data for Dickerson Manufacturing Company for the current year appear in Exhibit 5.29. Additional...

-

Refer to the data in Exercise 7. 18. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 direct labor hours. This usage is also...

-

What are the characteristics of a senior for: At-home assisted living * Assisted-living communities e Full-care living centers e Respite care LO.1

-

Emotional intelligence and team performance. Refer to the Engineering Project Organizational Journal (Vol. 3, 2013) study of the relationship between emotional intelligence of individual team members...

-

1. Critically comment on the results reported by CPCC under PRC GAAP, IFRS, and U.S. GAAP. 2. Identify the main areas of difference for CPCC between: a. PRC GAAP and IFRS. b. IFRS and U.S. GAAP. 3....

-

Describe the process of bookbuilding. I. The security firm engages in bookbuilding by checking the solvency of the issuing company and then setting the mandatory price range per share. II. The...

-

In order to maintain pump power requirements per unit flow rate below an acceptable level, operation of the oil pipeline of the preceding problem is subject to the constraint that the oil exit...

-

Which of the following is true about employee pay methods? a. Employees must be able to access the full amount of their net pay on the pay date. b. Employers must keep a record of all pay...

-

The owner of All Grains Bakery is considering offering additional payroll disbursal methods for the employees. Which of the following would be the safest for employees without a bank account? a....

-

Identify the quality problems that a company might encounter with the following global supply chain components: a. Overseas suppliers b. Container ships c. Transportation d. Packaging e. Distribution...

-

(a) Draw a simplified ray diagram showing the three principal rays for an object located inside the focal length of a converging lens, closer to the lens than to the focal point. (b) Is the image...

-

Power efficiency has become very important for modern processors, particularly for embedded systems. Create a version of gcc for two architectures that you have access to, such as x86, RISC-V,...

-

There is a movement toward wireless mobile computing using thin-client technology. Go to the Web and visit some of the ma jor computer vendors that are producing thin-client products such as handheld...

-

Draw a B-tree of order 4 and height 3 containing the fewest elements. Show an example of a split that would be applied by inserting the fewest number of elements.

-

Repeat Example 10-4, except calculate the diameter at the bottom of the column. Example 10-4 A distillation column is separating n-hexane from n-heptane using 1-in. ceramic Intalox saddles. The...

-

A drag racer is able to complete the 0.40-km course (0.25 mi)in 6.1 s. (a) If her acceleration is constant, what is a? (b) What is her speed when she is halfway to the finish line?

-

A 6-lb shell moving with a velocity ?? v0k explodes at point D into three fragments which hit the vertical wall at the points indicated. Fragments A, B, and C hit the wall 0.010 s, 0.018 s, and 0.012...

-

How did data governance improve operations and management decision making?

-

What business benefits did the companies and services described in this case achieve by analyzing and using big data.

-

Identify two decisions at the organizations described in this case that were improved by using big data, and two decisions that were not improved by using big data.

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

Study smarter with the SolutionInn App