Leda, Inc., is located at 433 Augusta Road, Caribou, Maine, 04736, phone number 207-555-1212. The Federal EIN

Question:

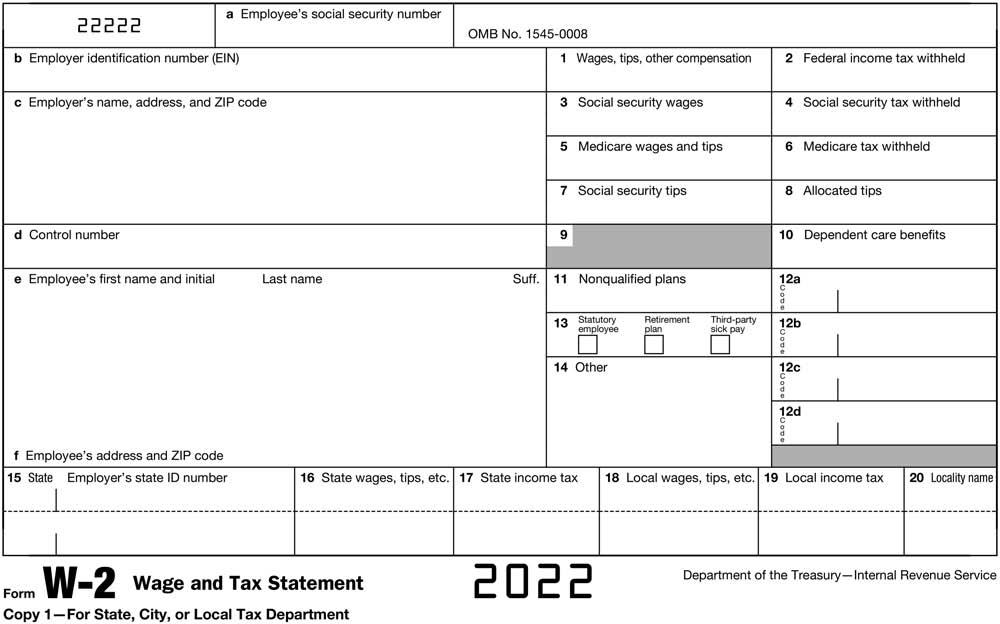

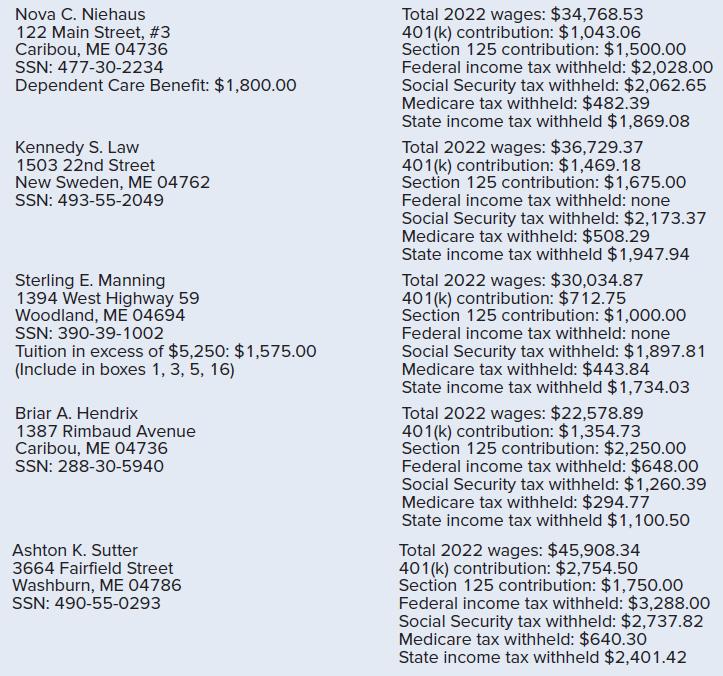

Leda, Inc., is located at 433 Augusta Road, Caribou, Maine, 04736, phone number 207-555-1212. The Federal EIN is 54-3910394, and it has a Maine Revenue Services number of 3884019. Owner Kieran Leda has asked you to prepare Form W-2 for each of the following employees of Leda, Inc., as of December 31, 2022. The same deductions are allowed for state as they are for federal.

Transcribed Image Text:

22222 b Employer identification number (EIN) a Employee's social security number c Employer's name, address, and ZIP code d Control number e Employee's first name and initial f Employee's address and ZIP code 15 State Employer's state ID number Last name OMB No. 1545-0008 W-2 Wage and Tax Statement Form Copy 1-For State, City, or Local Tax Department 1 Wages, tips, other compensation 3 Social security wages 5 Medicare wages and tips 7 Social security tips 9 Suff. 11 Nonqualified plans 13 employee 14 Other 16 State wages, tips, etc. 17 State income tax 2022 Retirement plan Third- d-party sick pay 2 Federal income tax withheld 4 Social security tax withheld 6 Medicare tax withheld 8 Allocated tips 10 Dependent care benefits 12a d 12b 00 12c 12d a 18 Local wages, tips, etc. 19 Local income. 20 Locality name Department of the Treasury-Internal Revenue Service

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

Answered By

Diksha Bhasin

I have been taking online teaching classes from past 5 years, i.e.2013-2019 for students from classes 1st-10th. I also take online and home tuitions for classes 11th and 12th for subjects – Business Studies and Economics from past 3 years, i.e. from 2016-2019. I am eligible for tutoring Commerce graduates and post graduates. I am a responsible for staying in contact with my students and maintaining a high passing rate.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Leda Inc. is located at 433 Augusta Road, Caribou, Maine, 04736, phone number 207-555-1212. The Federal EIN is 54-3910394, and a Maine Revenue Services number of 3884019. Owner, Amanda Leda has asked...

-

Leda Inc. is located at 433 Augusta Road, Caribou, Maine, 04736, phone number 201-555-1212. The Federal EIN is 54-3910394, and it has a Maine Revenue Services number of 3884019. Owner Amanda Leda has...

-

Leda Inc. is located at 433 Augusta Road, Caribou, Maine, 04736, phone number 201-555-1212. The Federal EIN is 54-3910394, and a Maine Revenue Services number of 3884019. Owner, Amanda Leda has asked...

-

A Xerox machine in a shop is operated by a person who does other jobs too. The average service time for a job is 6 minutes per customer. On an average, in every 12 minutes one customer arrives for...

-

(a) Show that the SI unit for magnetic moment multiplied by the SI unit for magnetic field yields the SI unit for torque. (b) If you are looking down onto the area of a current- carrying loop of wire...

-

Production Budgeting Jim Seagal is the CEO of Seagal Monitor Company, a manufacturer of computer monitors. Seagal manufactures three types of flat panel LCD computer monitors: 15-inch, 17-inch, and...

-

2. Show how the available cash will be distributed in final liquidation of the corporation. Corporate Liquidations and Reorganizations 623

-

Joseph Supersonic Company, a U.S. jet fighter manufacturer, is eager to sell its aircraft to the stateowned airline of the Republic of Platano and wishes to retain a local representative to assist...

-

#6) Marigold Recreational Vehicles Ltd. shares are currently selling for $38.20 each. You bought 200 shares one year ago at $34.35 and received dividend payments of $2.20 per share. What was your...

-

2. [5 pts.] Show the structure of the following table (ORDER) in the outline notation defining a primary key. Draw the dependency diagram, and, on the diagram, specify partial and/or transitive...

-

Using the information from P6-10A for Leda, Inc., completed Form W-3 must accompany the companys W-2 forms. Leda, Inc., is a 941 payer and is a private, for-profit company. Kieran Leda is the owner;...

-

Using the information from P6-6A and P6-7A for Veryclear Glassware (CaliforniaEmployer Account Number 999-9999-9), complete the following State of California Form DE-9, Quarterly Contribution, and...

-

In a particular month Northwest Medical Clinic reported the following: 1. It provided direct care services to patients, billing them $400,000. Of this amount it received $120,000 in cash, but as a...

-

Analysts and investors often use return on equity ( ROE ) to compare profitability of a company with other firms in the industry. ROE is considered a very important measure, and managers strive to...

-

Provide a brief summary of the case. Respond to the following: 1. Discuss the factors which contributed to the success of the change process in terms of unfreeze, move, and refreeze stages in force...

-

Prepare a proposal where a government agency meets with consumer groups and producers on how to address the shortages in rice, sugar, onions, and fuel, i.e. oil, gasoline and the like. Use the format...

-

Decided to embark on a personal improvement project centered around time management after reviewing the insightful workbook by Neuhauser et al. (2004). My decision was influenced by my recognition...

-

You are the Senior Manager of IAuditYou LLP, you were recently assigned to take over a very important client for the company, The engagement partner, Max Roff, has been the audit partner for the past...

-

Describe how to represent a 1:N strong entity relationship. Give an example other than one in this chapter.

-

What are technical skills At what level are they most important and why?

-

Fit Right, Inc., produces custom trailers for professional racers. Each trailer is built to customer specifications. During July, its first month of operations, Fit Right began production of four...

-

Dirt Bikes, Inc., produces custom motorized dirt bikes. Each dirt bike is built to customer specifications. During April, its first month of operations, Dirt Bikes began production of three customer...

-

Tax Services, Inc., provides tax accounting services and began operations on February 1. It began jobs 1 through 4 during the first half of February. The following transactions occurred that week. 1....

-

A firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8....

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

Study smarter with the SolutionInn App