Legends Leadworks is a monthly schedule depositor of payroll taxes. For the month of April 2022, the

Question:

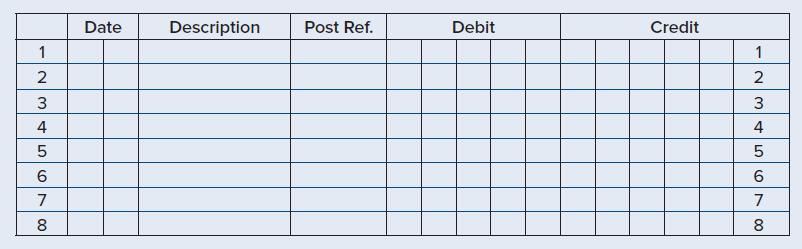

Legends Leadworks is a monthly schedule depositor of payroll taxes. For the month of April 2022, the payroll taxes (employee and employer share) were as follows:

Social Security tax: $5,386.56

Medicare tax: $1,259.76

Employee federal income tax: $4,978.00

Create the General Journal entry for the remittance of the taxes on May 14, 2022. Use check 1320 in the description.

Transcribed Image Text:

1 IN 2 3 45 5 6 7 8 00 Date Description Post Ref. Debit Credit 1 2 496AWN 3 5 7 8

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

Date May 14 2022 Description Payroll tax remittance f...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Legends Lead works is a monthly schedule depositor of payroll taxes. For the month of April, the payroll taxes (employee and employer share) were as follows?

-

KMH Industries is a monthly schedule depositor of payroll taxes. For the month of August, the payroll taxes (employee and employer share) were as follows:

-

The following payroll totals for the month of April are from the payroll register of Myth Corporation: salaries, $446,000; federal income taxes withheld, $62,880; Social Security tax withheld,...

-

1. The standard price per unit of materials is used in the calculation of which of the following variances? Materials price variance Materials quantity variance a NO NO b NO YES c YES NO d YES YES 2...

-

Baxter Company has two processing departments: Assembly and Finishing. A predetermined overhead rate of $10 per DLH is used to assign overhead to production. The company experienced the following...

-

Think again of the worst co-worker youve ever hadone who did some of the things listed in Table 1-1. Think of what that co-workers boss did (or didnt do) to try to improve his or her behaviour. What...

-

Under the debt financing alternative, only $100,000 is required at CF0 and the project will provide an annual return after debt service of $18,000 for each of the 5 years. In addition, the reversion...

-

For each of the following transactions, events, or circumstances, indicate whether the recognition criteria for revenues and gains are met and provide support for your answer. (a) An order of $25,000...

-

Jones Products manufactures and sells to wholesalers approximately 400,000 packages per year of underwater markers at $6 per package. Annual costs for the production and sale of this quantity are...

-

Courier Service Company Express-way provides service that allows someone to send parcels from one location to another domestically. The real-time tracking system helps the company to track the number...

-

Which of the following payroll-related accounts appear on the balance sheet? a. Wages and salaries payable b. Medicare tax expense c. Employee federal income tax payable d. FUTA tax expense

-

Using the employer payroll entry from P7-4A, post the employees share of the Social Security and Medicare taxes along with the employers share of payroll taxes for September 9 pay at White Mountain...

-

Martinsville Manufacturing Company develops parts for the automobile industry. The main product line is interior systems, especially seats and carpets. Martinsville operates in a single large plant...

-

The following information is available for two different types of businesses for the 2011 accounting period. Dixon Consulting is a service business that provides consulting services to small...

-

Marino Basket Company had a \(\$ 6,200\) beginning balance in its Merchandise Inventory account. The following information regarding Marino's purchases and sales of inventory during its 2011...

-

On March 6, 2011, Bob's Imports purchased merchandise from Watches Inc. with a list price of \(\$ 31,000\), terms \(2 / 10, n / 45\). On March 10, Bob's returned merchandise to Watches Inc. for...

-

The following events apply to Tops Gift Shop for 2012, its first year of operation: 1. Acquired \(\$ 45,000\) cash from the issue of common stock. 2. Issued common stock to Kayla Taylor, one of the...

-

Indicate whether each of the following costs is a product cost or a period (selling and administrative) cost. a. Transportation-in. b. Insurance on the office building. c. Office supplies. d. Costs...

-

Use Fig. 6.3 to specify suitable Schedule 40 pipe sizes for carrying the given volume fl ow rate of water in the suction line and in the discharge line of a pumped distribution system. Select the...

-

A bubble-point liquid feed is to be distilled as shown in Figure. Use the Edmister group method to estimate the mole-fraction compositions of the distillate and bottoms. Assume initial overhead and...

-

Analyze ConAgra's problems with its old system. What management, organization, and technology factors were responsible for these problems? What was the business impact of these problems?

-

List and describe the information requirements of My Recipe.

-

What types of system building methods and tools did ConAgra use for building its system?

-

You are the digital marketing director for High West fashions, a regional clothing company that specializes in custom t-shirts. Your company has decided to launch an online advertising campaign that...

-

In-the-money put options will automatically get exercised at the expiration. True OR False

-

Which of the following examples of business-use property is NOT eligible for Section 1231 treatment when sold at a gain? * Sale of land held for three years. Net gain from a casualty gain on a dump...

Study smarter with the SolutionInn App