The employees of Ethereal Bank are paid on a semimonthly basis. Compute the FICA taxes for the

Question:

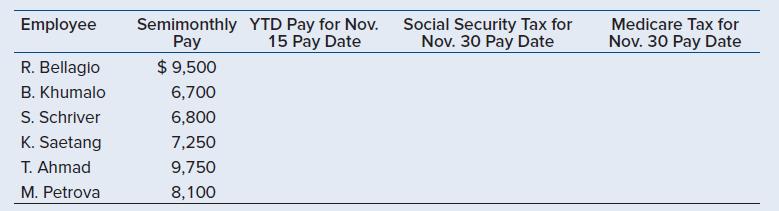

The employees of Ethereal Bank are paid on a semimonthly basis. Compute the FICA taxes for the employees for the November 30 payroll. All employees have been employed for the entire calendar year. All employees are single. There are no pre-tax deductions.

Transcribed Image Text:

Employee R. Bellagio B. Khumalo S. Schriver K. Saetang T. Ahmad M. Petrova Semimonthly Pay $ 9,500 6,700 6,800 7,250 9,750 8,100 YTD Pay for Nov. 15 Pay Date Social Security Tax for Nov. 30 Pay Date Medicare Tax for Nov. 30 Pay Date

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

To compute the FICA taxes for the employees for the November 30 payroll we need to determine the Soc...View the full answer

Answered By

Hafiz Muhammad Safdar Ali

I have been a tutor for the past 5 years. I have experience working with students in a variety of subject areas, including computer science, math, science, English, and history. I have also worked with students of all ages, from elementary school to college. In addition to my tutoring experience, I have a degree in education from a top university. This has given me a strong foundation in child development and learning theories, which I use to inform my tutoring practices.

I am patient and adaptable, and I work to create a positive and supportive learning environment for my students. I believe that all students have the ability to succeed, and it is my job to help them find and develop their strengths. I am confident in my ability to tutor students and help them achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

The employees of Agonnacultis, Inc., are paid on a semimonthly basis. Compute the FICA taxes for the employees for the November 15 payroll. All employees have been employed for the entire calendar...

-

The employees of Black Cat Designs are paid on a semimonthly basis. Compute the FICA taxes for the employees for the November 30, 2015, payroll. All employees have been employed for the entire...

-

The employees of Lillians Interiors are paid on a semimonthly basis. Compute the FICA taxes for the employees for December 31, 2022, pay period. All employees are single and have been employed for...

-

Review the Financial Statements provided to each group on Blackboard (You may use laptops for this exercise). [ Focus on: a) Is the company Profitable b) Does the company have a lot of liabilities c)...

-

Glencoe Medical Clinic operates a cardiology care unit and a maternity care unit. Colby Hepworth, the clinics administrator, is investigating the charges assigned to cardiology patients. Currently,...

-

. Why should human resource departments measure their effectiveness? What are some ways they can go about measuring effectiveness? (LO 9-6)

-

Random Number Generation Volunteers for an experiment are numbered from 1 to 70. The volunteers are to be randomly assigned to two different treatment groups. Use a random number generator different...

-

Pine Land Co. was formed when it acquired cash from the issue of common stock. The company then issued bonds at a premium on January 1, 2016. Interest is payable annually on December 31 of each year,...

-

A preferred stock will pay a dividend of $3.00 in the upcoming year and every year thereafter; i.e. dividends are not expected to grow. You require a return of 12% on this stock. Use the constant...

-

Connie recently provided legal services to the Winterhaven LLC and received a 5 percent interest in the LLC as compensation. Winterhaven currently has $43,000 of accounts payable and no other debt....

-

Would you like to know more about the Employment Cost Index? Check out the videosfrom the Bureau of Labor Statistics: www.bls.gov/eci/videos.htm

-

Would you like to preview employee apps used to enter time and to calculate payroll disbursements? Check out these links: DOL Timesheet: https://itunes.apple.com/us/app/dol-timesheet/id433638193?mt=8...

-

What is the maximum charitable contribution allowance for corporations? Is there a carryover to other years?

-

IRIS Ratio Analysis Spreadsheet Using the information presented below, calculate the ratios requested in the IRIS ratio section. All of your answers should be in percentage-format. Note that the...

-

https://www.youtube.com/watch?v=jQbXao0mQ1M 1. Identify the cultural misunderstandings that occurred during Kenichi Takahashi's meeting with Rob, Ella, and Stephanie. Explain and support your...

-

Using what you know of groups and teams, how do you get your teams back on track with Pat? What actions do you need to take as a leader to minimize/repair the negative impact Pat's has had on the...

-

The demand function for a certain product is given by p = 3000 2x + 100 (0 x 10) where x (measured in units of a thousand) is the quantity demanded per week and p is the unit price in dollars. Sketch...

-

QUESTION 4 Dr. Martin Luther King's Speech where he proclaimed, "Free at last! Free at last!" is an example of O A. Impromptu O B. Dissolving OC. Prepared D. Reference E.Planned Speaking Wording...

-

Evaluate the four scenarios presented in Section 2.1.2 from an act utilitarian perspective.

-

Chris Zulliger was a chef at the Plaza Restaurant in the Snowbird Ski Resort in Utah. The restaurant is located at the base of a mountain. As a chef for the Plaza, Zulliger was instructed by his...

-

The balance in Amber Companys work-in-process inventory account was $400,000 at the beginning of September and $320,000 at the end of September. Manufacturing costs for the month follow. Required:...

-

Boulder Products, Inc., had the following activity for the month of October. Required: Prepare an income statement for the month of October. Sales revenue Selling expenses General and administrative...

-

Home Depots annual report appears as follows in summary form. (This information was obtained from the companys Web site, www.homedepot.com. Required: a. The financial information in the companys...

-

crane Inc. common chairs currently sell for $30 each. The firms management believes that it's share should really sell for $54 each. If the firm just paid an annual dividend of two dollars per share...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

Study smarter with the SolutionInn App