Using the employer payroll entry from P7-4B, post the employers share of payroll taxes for the March

Question:

Using the employer payroll entry from P7-4B, post the employer’s share of payroll taxes for the March 11 pay period at Appalachian Limited Home Design to the appropriate General Ledger accounts. Employees are paid weekly. Assume a 5.4 percent SUTA rate and 0.6 percent FUTA rate, and assume that $954.05 of the gross pay is subject to SUTA and FUTA taxes.

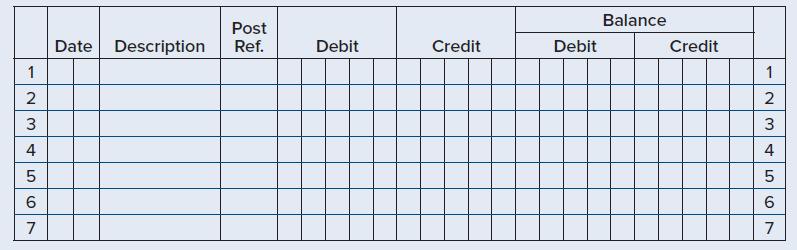

Account: Payroll Taxes Expense

Account: Social Security Tax Payable

Account: Medicare Tax Payable

Account: Federal Unemployment Tax Payable

Account: State Unemployment Tax Payable

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted: