What factors affect how much federal income tax is withheld from an employees pay using Form W-4?

Question:

What factors affect how much federal income tax is withheld from an employee’s pay using Form W-4?

Transcribed Image Text:

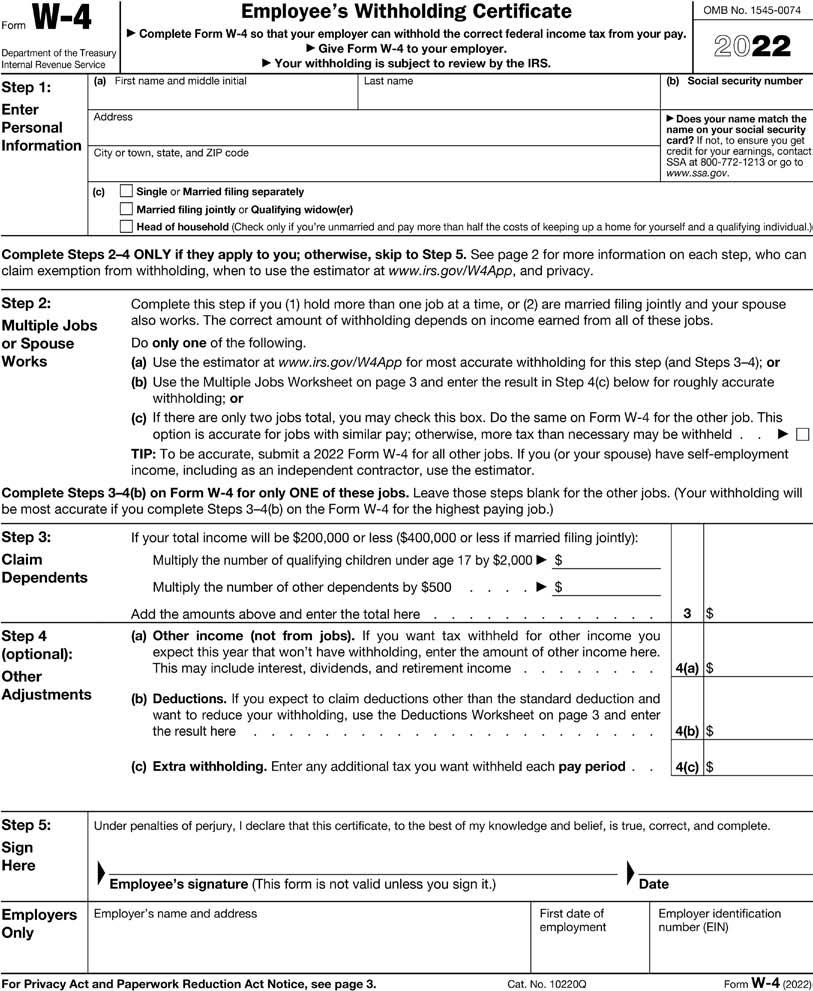

W-4 Department of the Treasury Internal Revenue Service Form Step 1: Enter Personal Information Step 3: Claim Dependents (a) First name and middle initial Step 4 (optional): Other Adjustments Employee's Withholding Certificate ► Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ► Give Form W-4 to your employer. ►Your withholding is subject to review by the IRS. Last name Address Step 2: Multiple Jobs or Spouse Works Step 5: Sign Here City or town, state, and ZIP code (c) Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) If your total income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ Multiply the number of other dependents by $500 Add the amounts above and enter the total here. (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income Do only one of the following. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here (c) Extra withholding. Enter any additional tax you want withheld each pay period.. OMB No. 1545-0074 (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld. O TIP: To be accurate, submit a 2022 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. 2022 (b) Social security number Employee's signature (This form is not valid unless you sign it.) ►Does your name match the name on your social security card? If not, to ensure you get credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. Employers Employer's name and address Only For Privacy Act and Paperwork Reduction Act Notice, see page 3. First date of employment Cat. No. 10220Q Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete. Date 3 $ 4(a) S 4(b) $ 4(c) $ Employer identification number (EIN) Form W-4 (2022)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

answer The employees filing status Single Married Filing Jointly Married Filing Sep...View the full answer

Answered By

Churchil Mino

I have been a tutor for 2 years and have experience working with students of all ages and abilities. I am comfortable working with students one-on-one or in small groups, and am able to adapt my teaching style to meet the needs of each individual. I am patient and supportive, and my goal is to help my students succeed.

I have a strong background in math and science, and have tutored students in these subjects at all levels, from elementary school to college. I have also helped students prepare for standardized tests such as the SAT and ACT. In addition to academic tutoring, I have also worked as a swim coach and a camp counselor, and have experience working with children with special needs.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

What factors affect how much federal income tax must be withheld from an employee's earnings?

-

How much federal income tax should Aman report if she earned taxable income of $32 920 and $17 700 from her two jobs? Use the 2012 federal income tax brackets and rates in Table 3.3 to answer the...

-

What amount of income tax is withheld from the salary of an employee who is single with two withholding allowances and earns $725 per week? What if the employee earns $625 and has no withholding...

-

Need assistance on adding accounting info to the excel worksheet posted. A.) would 97,400 go under cash or fixed assets ? Number Styles Cells Editing Ideas g Cash Balance B. C D E H. K M T. 0,1,F...

-

Consider the data for each of the following four independent companies: Required: 1. Calculate the missing values in the above table. (Round rates to four signicant digits.) 2. Assume that the cost...

-

What are some examples of prominent interorganizational networks in your local community?

-

The chapter mentions that regular functional managers are moving from their classic authoritarian style to a facilitative, participatory style because it is more effective. Do you think it took...

-

Was Jay Cohens conviction justified?

-

McWherter Instruments sold $610 million of 10% bonds, dated January 1, on January 1, 2021. The bonds mature on December 31, 2040 (20 years). For bonds of similar risk and maturity, the market yield...

-

During August 2023, Patty O'Furniture Repair Service experienced the following transactions: 1. Aug 2 - Issued shares of common stock in exchange for cash, $4,000 2. Aug 4 - Purchased equipment for...

-

How do post-tax deductions differ from pre-tax deductions?

-

To which two months does the special accounting rule pertain? a. January and February b. November and December c. The last two months of the companys fiscal year d. December and January of the...

-

Variable X takes on the values shown in the following table for five observations. The table also shows the values for five other variables, Y1 through Y5. Which of the variables Y1 through Y5 have a...

-

Global Operations Management is supported by Strategic Supply Chain Management in many ways. Elucidate the following; List and briefly define/describe the Five (5) Components of Strategic Supply...

-

The Alpine House, Inc. is a large winter sports equipment broker. Below is an income statement for the company's ski department for a recent quarter. LA CASA ALPINA, INC. Income Statement - Ski...

-

Two investment portfolios are shown. Investment Portfolio 1 Portfolio 2 ROR Savings Account $1,425 $4,500 2.80% Government Bond $1,380 $3,600 1.55% Preferred Stock $3,400 $2,150 11.70% Common Stock...

-

The following information pertains to JAE Corporation at January 1, Year 1: Common stock, $8 par, 11,000 shares authorized, 2,200 shares issued and outstanding Paid-in capital in excess of par,...

-

Group dynamics are important elements within the leading facet of the P-O-L-C framework. Discuss a time in your professional, school, or personal life when you experienced the Five Stages of Group...

-

A 35-m-wide river flows in a straight line (the x direction) with a speed of 0.25 m/s. A boat is rowed such that it travels directly across the river (along y). If the boat takes exactly 4 minutes to...

-

In Exercises 516, find the focus and directrix of the parabola with the given equation. Then graph the parabola. y 2 = 4x

-

In your own words, discuss the integrated marketing communications concept. Explain what its emphasis on consistent and complete messages implies with respect to promotion blends.

-

Relate the three basic promotion objectives to the four jobs (AIDA) of promotion using a specific example.

-

Discuss the communication process in relation to a producers promotion of an accessory productsay, a new electronic security system businesses use to limit access to areas where they store...

-

Los datos de la columna C tienen caracteres no imprimibles antes y despus de los datos contenidos en cada celda. En la celda G2, ingrese una frmula para eliminar cualquier carcter no imprimible de la...

-

Explain impacts of changing FIFO method to weighted average method in inventory cost valuations? Explain impacts of changing Weighted average method to FIFO method in inventory cost valuations?...

-

A perpetuity makes payments starting five years from today. The first payment is 1000 and each payment thereafter increases by k (in %) (which is less than the effective annual interest rate) per...

Study smarter with the SolutionInn App