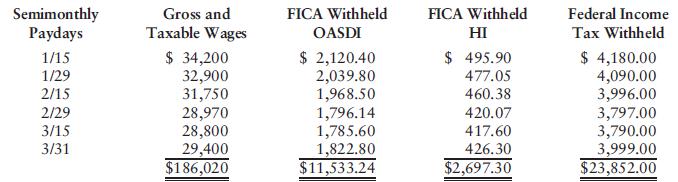

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter

Question:

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2016 follow.

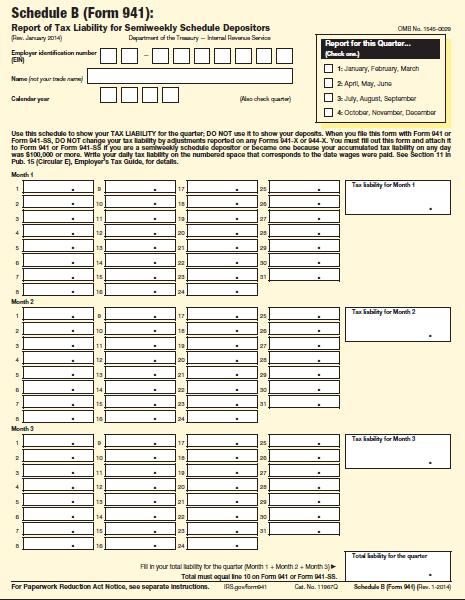

a. Complete Schedule B of Form 941 on page 3-65 for the first quarter for Harry Conway, the owner of Hamilton Company.

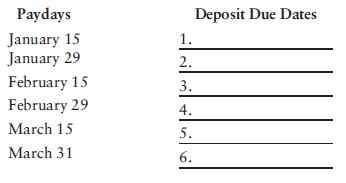

b. Below list the due dates of each deposit in the first quarter.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2017 follow. a. Complete Schedule B of Form 941 on page 3-65 for the first...

-

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2013 follow. a. Complete Schedule B of Form 941 on page 3-64 for the first...

-

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2018 follow. a. Complete Schedule B of Form 941 on page 3-67 for the first...

-

On January 1, 2018, JKJ purchased a 1,000 acre farm with a building. The asking price was $2,600,000. Approximately 15 percent of the total value of the farm was allocable to the building and the...

-

Using the information in Table 4.9 about Scenario C: a. What is the expected quantity of production? b. Suppose you short the expected quantity of corn. What is the standard deviation of hedged...

-

Create your own examples of open and closed questions. In the past, which type of question would you have been most likely to ask?

-

3. This problem has been intentionally omitted for this edition.

-

Prepare journal entries to record the following merchandising transactions of IKEA, which uses the perpetual inventory system and gross method. May 2 Purchased merchandise from Havel Co. for $10,000...

-

The Maroon & Orange Gym, Inc., uses the calendar tax year and the accrual method of accounting. The corporation sells memberships that entitle the member to use the facilities at any time. A one-year...

-

At the beginning of its operations in July 2024, Wheaton Pet Shop Ltd. began with 9,500 units of inventory that it purchased at a cost of $15.00 each. The companys purchases during July were as...

-

Refer to Problem 3-11B. Complete Parts 2, 4, and 5 of Form 941 (on page 3-57) for Gallagher Company for the third quarter of 2016. Gallagher Company is a monthly depositor with the following monthly...

-

Analyze each of the following investigations, or arguments, and indicate which of the methods of causal reasoningMills methodsare being used in each of them: Some theories arise from anecdotal...

-

The 3 4-m side of an open tank is hinged at its bottom A and is held in place by a thin rod BC. The tank is to be filled with glycerine, whose density is 1263 kg/m3. Determine the force T in the rod...

-

Turn this information into an excel sheets with the excel formulas being shown P12.2 (LO 1, 2) (Liability Entries and Adjustments) Listed below are selected transactions of Schultz Department Store...

-

1. Consider an undirected random graph on the set of four vertices {A, B, C, D} such that each of the 4 2 = 6 potential edges exists with probability 0.2, independently of the presence/absence of any...

-

Basic Net Present Value Analysis Jonathan Butler, process engineer, knows that the acceptance of a new process design will depend on its economic feasibility. The new process is designed to improve...

-

Determine the support reactions at the smooth collar A and the normal reaction at the roller support B. 800 N 600 N B 0.8 m 0.4 m 0.4 m 0.8 m

-

A plant hopes to cool a steam line by sending it through a throttling valve to expand it to atmospheric pressure. The steam enters the valve at 550C and 250 bar. The expansion in the valve happens so...

-

Consider the 5-bit generator, G = 10011, and suppose that D has the value 1010101010. What the value of R?

-

Use of the contraceptive Depo Provera appears to triple women's risk of infection with chlamydia and gonorrhea , a study reports today. An estimated 20 million to 30 million women worldwide use Depo...

-

On September 30, Cody Companys selected account balances are as follows: In general journal form, prepare the entries to record the following: Oct. 15 Payment of liabilities for FICA taxes and the...

-

On September 30, Hilltop Companys selected payroll accounts are as follows. Prepare general journal entries to record the following: Oct. 15 Payment of federal tax deposit of FICA taxes and the...

-

Great Manufacturing Company received and paid a premium notice on January 2 for workers compensation insurance stating the rates for the New Year. Estimated employees earnings for the year are as...

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App