Joan died April 17, 2022. Joans executor chose March 31 as the tax year end for the

Question:

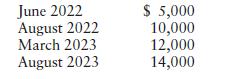

Joan died April 17, 2022. Joan’s executor chose March 31 as the tax year end for the estate. The estate’s only beneficiary, Kathy, reports on a calendar year. The executor of Joan’s estate makes the following distributions to Kathy:

The 2022 and 2023 distributions do not exceed DNI. How much income should Kathy report on her 2022 return as a result of the distributions from the estate? On her 2023 return?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation Corporations Partnerships Estates And Trusts 2024

ISBN: 9780138101787

37th Edition

Authors: Luke E. Richardson, Mitchell Franklin

Question Posted: