1. After reviewing the earnings multiple approach and the needs approach, Cory and Tisha opt for the...

Question:

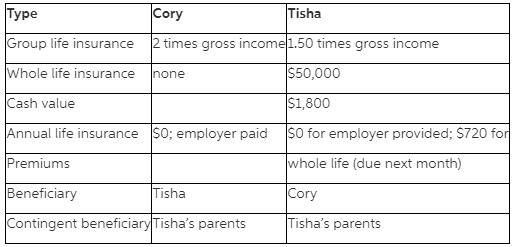

1. After reviewing the earnings multiple approach and the needs approach, Cory and Tisha opt for the simpler earnings multiple approach to estimate their life insurance needs. As Cory explains, “There are just too many unknowns in that needs approach formula. Years of income to be replaced I can understand. If I die tomorrow, I want to know that Tisha can buy a home and the kids can finish college. Chad is 4 and Haley is 2. With 20 years of my income, they should be able to do that.” Tisha agrees, although she cautions that before purchasing insurance she would like to confirm their estimates by completing the needs formula. They agree that they could earn a 5 percent after-tax, after-inflation return on the insurance benefit. Do Tisha and Cory have adequate life insurance? If not, how much should each consider purchasing? (Hint: Remember that expenses drop by 22 percent for a surviving family of three. Be sure to consult Table 9.2, “Earnings Multiples for Life Insurance.”)

2. All of Cory’s life insurance and half of Tisha’s are provided through their employers. Is this a good idea?

3. Cory’s been on the Internet again, this time to read about universal life and variable life insurance. He has asked your opinion about purchasing one of these policies to provide additional insurance coverage for his family. What would you advise him to do? Defend your answer.

4. The Dumonts have asked you to review their life insurance policies and explain them “in plain English.” What standard life insurance policy clauses or optional riders would you consider to be most important to Cory and Tisha?

5. An insurance agent recently suggested purchasing whole life policies for Chad and Haley. Costs would be cheap, and Cory and Tisha could rest assured that the kids would always be insured. Is this a good idea? Defend your answer.

6. Do Tisha and Cory have adequate health insurance? If not, what changes would you suggest and why?

7. Assume Tisha is injured in a car accident and incurs $5,000 of medical bills. What are the options for paying these bills? How would your answer change if the $5,000 of medical bills resulted from an emergency appendectomy? Assuming that no one else in her family has made a claim this year, how much of these bills will her insurance company pay?

8. Next month is the “annual open enrollment period” for health insurance benefits through Tisha’s employer. It is the only time of the year when she can make changes to her policy. Tisha is considering switching to a different HMO or PPO plan. What are the advantages and disadvantages of each form of managed care?

9. Tisha is concerned about a possible layoff due to mergers among several accounting firms. What are some health insurance options available to the Dumonts if Tisha is “downsized”? What are the advantages and disadvantages of Cory “opting out” in this situation? Tisha has considered self-employment from a home office. How will this affect their options for family health-care coverage?

10. Both Tisha and Cory are considering the purchase of disability insurance because Cory has none and Tisha’s employer-provided policy is very short-term. What policy features would you recommend they include?

11. Do Tisha and Cory have adequate renter’s insurance? What recommendation would you make? Why?

12. Evaluate the Dumonts’ auto insurance. What recommendations for changes, if any, would you make? Why?

13. How much would the Dumonts’ policy pay if Cory or Tisha was at fault for an accident that resulted in $65,000 of bodily injury losses? How would the claim be paid?

14. What policy options could the Dumonts select to reduce the cost of their property and liability insurance?

Cory and Tisha read a recent newspaper article stating that personal bankruptcy and other financial problems often result from uninsured losses. This made them curious about their own insurance coverage, so they have come back to you for assistance. Because they want to buy a home very soon, they are also interested in homeowner’s insurance. They compiled the following information for you to review.

Health Insurance Tisha’s employer provides a comprehensive major medical insurance policy that covers all members of the Dumont family with an 80/20 coinsurance provision. The Dumonts are subject to a $500 annual family deductible. Tisha’s employer deducts $267 per month toward the premium; her employer pays the remainder of the premium. Because Tisha’s company offered the better coverage, Cory chose to “opt out” of his coverage and receives an “opt out fee” of $100 per month (included in gross income).

Step by Step Answer:

Personal Finance Turning Money into Wealth

ISBN: 978-0134730363

8th edition

Authors: Arthur J. Keown