About six months ago, Jennie inherited a portfolio that included a number of bonds. Jennie knows very

Question:

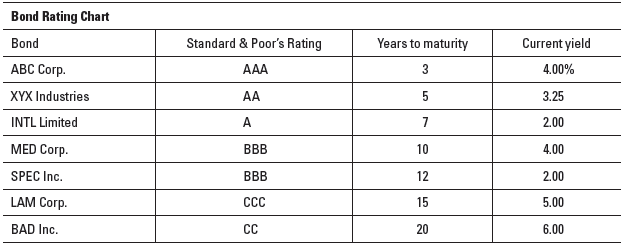

About six months ago, Jennie inherited a portfolio that included a number of bonds. Jennie knows very little about investing in general, and practically nothing about bonds specifically. She put together the following chart for your review. All Jennie knows for sure is that she owns seven bonds, ranging in maturity from 3 to 20 years. The chart below indicates the bond, its Standard & Poor’s Rating, its maturity, and its current yield.

After a cursory review of the yields, do you see anything that should cause Jennie to worry? In terms of bond maturity dates and the Standard & Poor’s ratings, is Jennie being adequately compensated for the risk she is taking? Based on the information provided, which bond should offer the highest current yield? The lowest? What is the present value of Jennie’s bond portfolio? Assume that each bond has a par value of $10000 and that each pays a coupon of 6 percent payable quarterly. Interest is compounded quarterly.

CouponA coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: