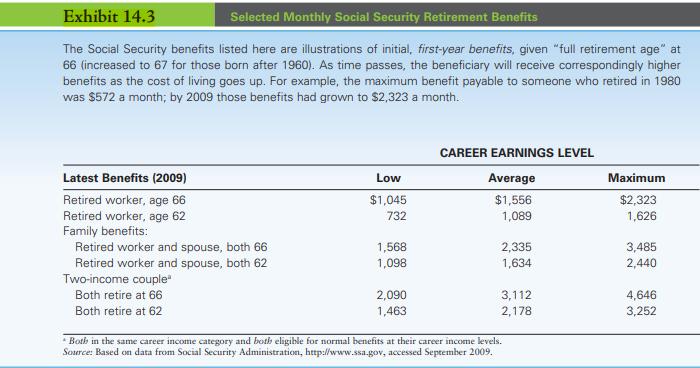

Use Exhibit 14.3 to determine the amount of Social Security retirement benefits that Henry Underwood would receive

Question:

Use Exhibit 14.3 to determine the amount of Social Security retirement benefits that Henry Underwood would receive annually if he had a high (i.e., “maximum”) level of career earnings, is age 62, has a dependent wife (also age 62), and has a part-time job that pays him $24,000 a year. If Henry also receives another $47,500 a year from a company pension and some tax-exempt bonds that he holds, will he be liable for any tax on his Social Security income? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Personal Financial Planning

ISBN: 9781439044476

12th Edition

Authors: Lawrence J. Gitman, Michael D. Joehnk, Randy Billingsley

Question Posted: