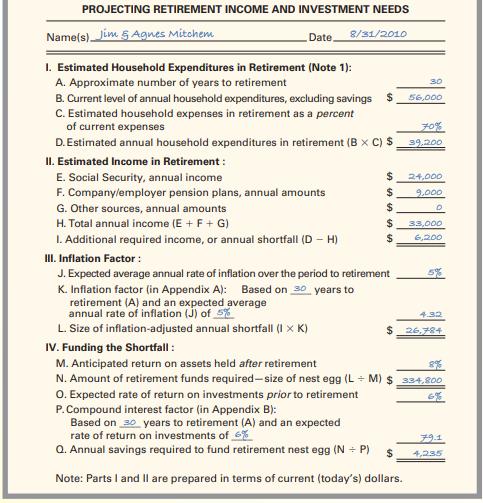

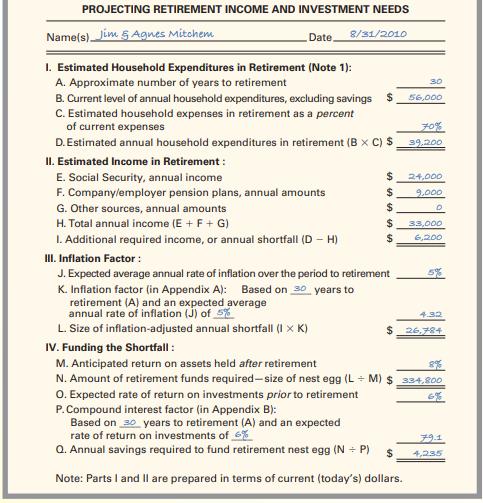

Question:

Use Worksheet 14.1 to assist Sandra Rorrer with her retirement planning needs. She plans to retire in 15 years, and her current household expenditures run about $50,000 per year. Sandra estimates that she’ll spend 80% of that amount in retirement. Her Social Security benefit is estimated at $15,000 per year, and she’ll receive $12,000 per year from her employer’s pension plan (both in today’s dollars). Additional assumptions include an inflation rate of 4% and a rate of return on retirement assets of 8% a year before retirement and 5% afterward. Use Worksheet 14.1 to calculate the required size of Sandra’s retirement nest egg and the amount that she must save annually over the next 15 years to reach that goal.

Worksheet 14.1

Transcribed Image Text:

PROJECTING RETIREMENT INCOME AND INVESTMENT NEEDS Name(s) Jim Agnes Mitchem Date 8/31/2010 I. Estimated Household Expenditures in Retirement (Note 1): A. Approximate number of years to retirement 30 B. Current level of annual household expenditures, excluding savings $ C. Estimated household expenses in retirement as a percent of current expenses 56,000 70% D. Estimated annual household expenditures in retirement (B x C) $ 39,200 II. Estimated Income in Retirement: E. Social Security, annual income $ 24,000 F. Company/employer pension plans, annual amounts $ 9,000 G. Other sources, annual amounts $ H. Total annual income (E + F + G) $ 33,000 I. Additional required income, or annual shortfall (D - H) $ 6,200 III. Inflation Factor: J. Expected average annual rate of inflation over the period to retirement 5% K. Inflation factor (in Appendix A): Based on 30 years to retirement (A) and an expected average annual rate of inflation (J) of 5% L. Size of inflation-adjusted annual shortfall (1 K) IV. Funding the Shortfall: M. Anticipated return on assets held after retirement 4.32 26,784 8% N. Amount of retirement funds required-size of nest egg (L+M) $334,800 O. Expected rate of return on investments prior to retirement 6% P. Compound interest factor (in Appendix B): Based on 30 years to retirement (A) and an expected rate of return on investments of 6% 79.1 Q. Annual savings required to fund retirement nest egg (NP) $ 4,235 Note: Parts I and II are prepared in terms of current (today's) dollars.