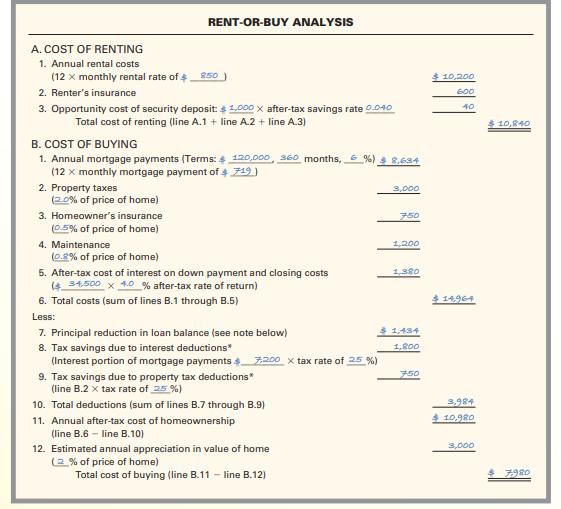

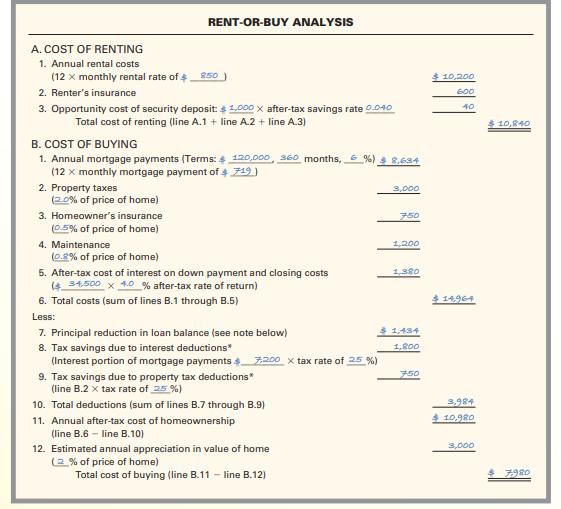

Question:

Use Worksheet 5.2. Rosa Ramirez is currently renting an apartment for $725 per month and paying $275 annually for renter’s insurance. She just found a small townhouse she can buy for $185,000. She has enough cash for a $10,000 down payment and $4,000 in closing costs. Her bank is offering 30-year mortgages at 6% per year. Rosa estimated the following costs as a percentage of the home’s price: property taxes, 2.5%; homeowner’s insurance, 0.5%; and maintenance, 0.7%. She is in the 25% tax bracket and has an after-tax rate of return on invested funds of 4%. Using Worksheet 5.2, calculate the cost of each alternative and recommend the less costly option—rent or buy—for Rosa.

Worksheet 5.2

Transcribed Image Text:

RENT-OR-BUY ANALYSIS A. COST OF RENTING 1. Annual rental costs (12 x monthly rental rate of $850 2. Renter's insurance 3. Opportunity cost of security deposit: $1,000 x after-tax savings rate 0.040 Total cost of renting (line A.1 + line A.2 + line A.3) B. COST OF BUYING 1. Annual mortgage payments (Terms: $ 120,000, 360 months, 6% ) $ 8,634 (12 x monthly mortgage payment of $719) 2. Property taxes (20% of price of home) 3. Homeowner's insurance (0.5% of price of home) 4. Maintenance 3,000 750 1,200 $ 10,200 600 40 $ 10,840 (0.8% of price of home) 5. After-tax cost of interest on down payment and closing costs 1,380 (434,500 x 40 % after-tax rate of return) 6. Total costs (sum of lines B.1 through B.5) $14,964 Less: 7. Principal reduction in loan balance (see note below) $1,434 8. Tax savings due to interest deductions* 1,800 (Interest portion of mortgage payments $ 7,200 x tax rate of 25 %) 9. Tax savings due to property tax deductions* 750 (line B.2 tax rate of 25 %) 10. Total deductions (sum of lines B.7 through B.9) 3,984 11. Annual after-tax cost of homeownership 10,980 (line B.6 -line B.10) 12. Estimated annual appreciation in value of home (2% of price of home) Total cost of buying (line B.11 -line B.12) 3,000 7980