Question:

Use Worksheet 7.2. Marie Herrera wants to buy a home entertainment center. Complete with a big-screen TV, DVD, and sound system, the unit would cost $4,500. Marie has over $15,000 in a money fund, so she can easily afford to pay cash for the whole thing (the fund is currently paying 5% interest, and Marie expects that yield to hold for the foreseeable future). To stimulate sales, the dealer is offering to finance the full cost of the unit with a 36-month installment loan at 9%, simple. Marie wants to know: Should she pay cash for this home entertainment center or buy it on time? Briefly explain your answer.

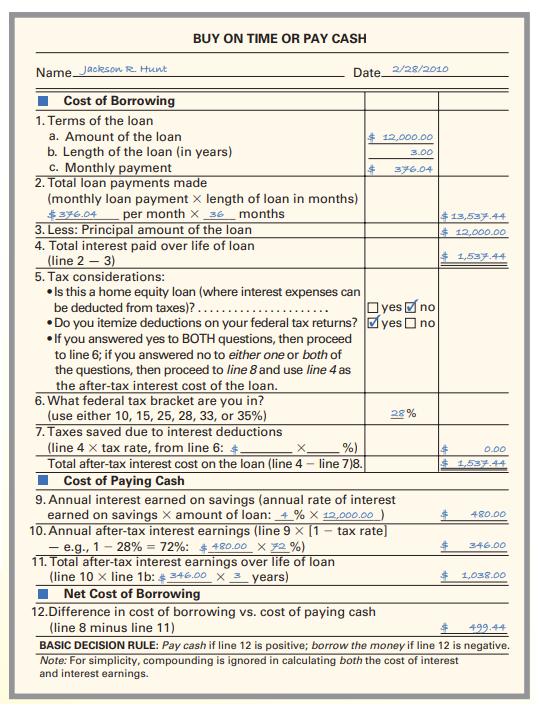

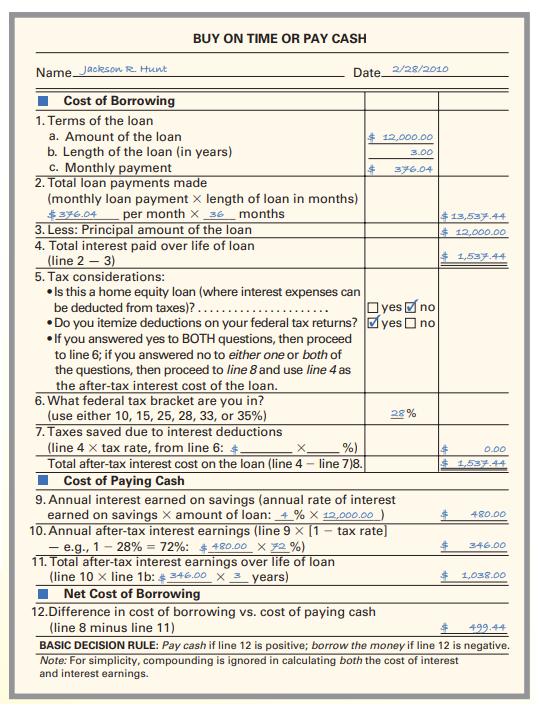

Worksheet 7.2

a. Should she pay cash for the entertainment center?

b. Rework the problem assuming Marie has the option of using a 48-month, 9.5% home equity loan to finance the full cost of this entertainment center. Again, use Worksheet 7.2 to determine if Marie should pay cash or buy on time. Does your answer change from the one you came up with in part a? Explain.

Transcribed Image Text:

Date 2/28/2010 Name Jackson R. Hunt Cost of Borrowing 1. Terms of the loan BUY ON TIME OR PAY CASH a. Amount of the loan b. Length of the loan (in years) c. Monthly payment 2. Total loan payments made $12,000.00 3.00 376.04 (monthly loan payment X length of loan in months) $376.04 per month X 36 months 3. Less: Principal amount of the loan 4. Total interest paid over life of loan (line 2-3) 5. Tax considerations: Is this a home equity loan (where interest expenses can be deducted from taxes)?.. Do you itemize deductions on your federal tax returns? If you answered yes to BOTH questions, then proceed to line 6; if you answered no to either one or both of the questions, then proceed to line 8 and use line 4 as the after-tax interest cost of the loan. 6. What federal tax bracket are you in? (use either 10, 15, 25, 28, 33, or 35%) 7. Taxes saved due to interest deductions (line 4 x tax rate, from line 6: yes no yes no 28% %) Total after-tax interest cost on the loan (line 4 - line 7)8. Cost of Paying Cash 9. Annual interest earned on savings (annual rate of interest earned on savings X amount of loan: 4% X 12,000.00) 10. Annual after-tax interest earnings (line 9 [1 - tax rate] -e.g., 1 -28% 72% : $480.00 X 72%) 11. Total after-tax interest earnings over life of loan (line 10 x line 1b: 346.00 X 3 years) Net Cost of Borrowing 12.Difference in cost of borrowing vs. cost of paying cash (line 8 minus line 11) $13,537.44 $12,000.00 1,537.44 $ 0.00 $1,537.44 480.00 346.00 1,038.00 499.44 BASIC DECISION RULE: Pay cash if line 12 is positive; borrow the money if line 12 is negative. Note: For simplicity, compounding is ignored in calculating both the cost of interest and interest earnings.