Consider CREF, the College Retirement Equities Fund, which manages retirement accounts for employees of nonprofit educational and

Question:

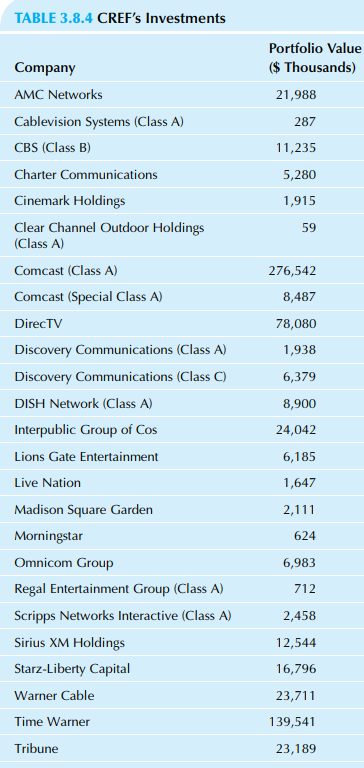

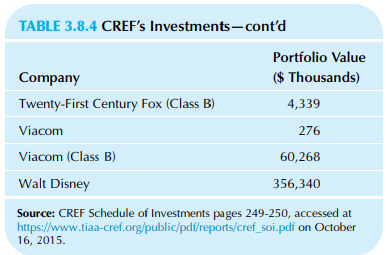

Consider CREF, the College Retirement Equities Fund, which manages retirement accounts for employees of nonprofit educational and research organizations. CREF manages a large and diversified portfolio in its growth stock account, somewhere around $22.5 billion. Investment in media represents 5.0% of this portfolio. Data on the market value of these CREF media investments are shown in Table 3.8.4.

a. Construct a histogram of this data set.

b. Based on this histogram, describe the distribution of CREF’s investment in the media sector.

c. Describe the shape of the distribution. In particular, is it skewed or symmetric?

d. Find the logarithm of each data value.

e. Construct a histogram of these logarithms.

f. Describe the distribution shape of the logarithms. In particular, is it skewed or symmetric?

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer: