Question: For the company AFC in section 8. 4, compute the values of RM, WIP, and FG inventory at the end of the period, as well

For the company AFC in section 8. 4, compute the values of RM, WIP, and FG inventory at the end of the period, as well as the cost of goods sold and gross profit for the period, assuming

(a) a FIFO and

(b) an average cost flow assumption.

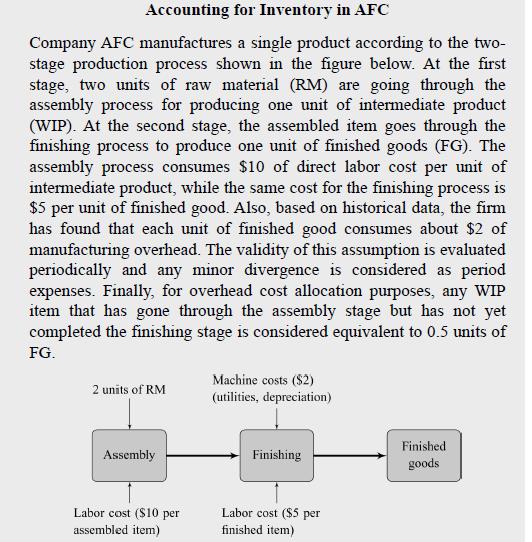

Accounting for Inventory in AFC Company AFC manufactures a single product according to the two- stage production process shown in the figure below. At the first stage, two units of raw material (RM) are going through the assembly process for producing one unit of intermediate product (WIP). At the second stage, the assembled item goes through the finishing process to produce one unit of finished goods (FG). The assembly process consumes $10 of direct labor cost per unit of intermediate product, while the same cost for the finishing process is $5 per unit of finished good. Also, based on historical data, the firm has found that each unit of finished good consumes about $2 of manufacturing overhead. The validity of this assumption is evaluated periodically and any minor divergence is considered as period expenses. Finally, for overhead cost allocation purposes, any WIP item that has gone through the assembly stage but has not yet completed the finishing stage is considered equivalent to 0.5 units of FG. 2 units of RM Machine costs ($2) (utilities, depreciation) Assembly Labor cost ($10 per assembled item) Finishing Labor cost ($5 per finished item) Finished goods

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts