Question: If the discount rate in exercise Automato Inc. in section 12.2.1 had been 18 percent, the resulting NPV would have been ($10,000.) Given that the

If the discount rate in exercise Automato Inc. in section 12.2.1 had been 18 percent, the resulting NPV would have been \($10,000.\) Given that the cost of the study made by the consulting firm was \($20,000,\) it seems that the total value of the project would have been negative. Under such circumstances, should the equipment have been acquired?

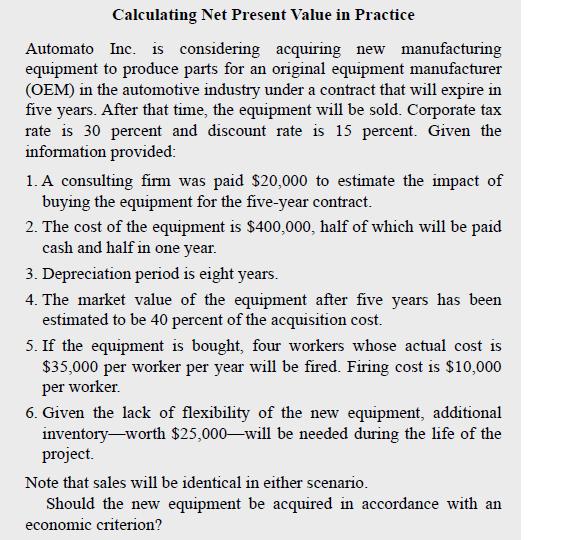

Calculating Net Present Value in Practice Automato Inc. is considering acquiring new manufacturing equipment to produce parts for an original equipment manufacturer (OEM) in the automotive industry under a contract that will expire in five years. After that time, the equipment will be sold. Corporate tax rate is 30 percent and discount rate is 15 percent. Given the information provided: 1. A consulting firm was paid $20,000 to estimate the impact of buying the equipment for the five-year contract. 2. The cost of the equipment is $400,000, half of which will be paid cash and half in one year. 3. Depreciation period is eight years. 4. The market value of the equipment after five years has been estimated to be 40 percent of the acquisition cost. 5. If the equipment is bought, four workers whose actual cost is $35,000 per worker per year will be fired. Firing cost is $10,000 per worker. 6. Given the lack of flexibility of the new equipment, additional inventory-worth $25,000-will be needed during the life of the project. Note that sales will be identical in either scenario. Should the new equipment be acquired in accordance with an economic criterion?

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts