Question: Revisiting the SoundPro example in section 13.5.3: a. Show that the value of the option to expand increases in the volatility of future cash flows.

Revisiting the SoundPro example in section 13.5.3:

a. Show that the value of the option to expand increases in the volatility of future cash flows. To do so, consider the cases that the high demand scenario may materialize with probabilities 60 percent and 50 percent.

b. Assume that a discount rate of 10 percent applies to any investment made in year 3 (given that the high demand scenario materializes), due to lower risk for the firm’s investors. What would be the value of the options 2 and 3 in this case?

In problems 2 to 5, please use the logic of options through decision trees and classical discounted cash flows techniques—rather than a formal real options valuation approach—to approximate the value of options available to the corresponding investments.

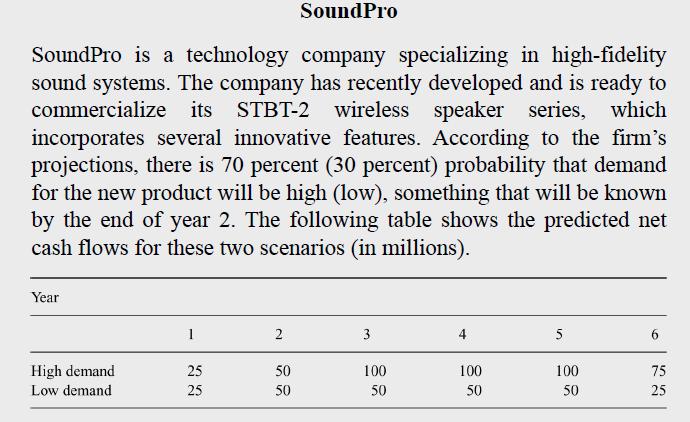

SoundPro SoundPro is a technology company specializing in high-fidelity sound systems. The company has recently developed and is ready to commercialize its STBT-2 wireless STBT-2 wireless speaker series, which incorporates several innovative features. According to the firm's projections, there is 70 percent (30 percent) probability that demand for the new product will be high (low), something that will be known by the end of year 2. The following table shows the predicted net cash flows for these two scenarios (in millions). Year 1 2 3 4 5 High demand Low demand 25 25 50 25 50 50 100 550 100 580 100 50 50 6 75 225 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts