GMC wants to decide whether to retool the Lyra and Libra plants. In addition, GMC wants to

Question:

GMC wants to decide whether to retool the Lyra and Libra plants. In addition, GMC wants to determine its production plan at each plant in the coming year. Based on the previous data, formulate a MILP model for solving GMC's production planning–capacity expansion problem for the coming year.

This case deals with strategic planning issues for a large company. The main issue is planning the company's production capacity for the coming year. At issue is the overall level of capacity and the type of capacity'for example, the degree of flexibility in the manufacturing system. The main tool used to aid the company's planning process is a mixed integer linear programming (MILP) model. A mixed integer program has both integer and continuous variables.

Problem Statement:

The Giant Motor Company (GMC) produces three lines of cars for the domestic (U.S.) market: Lyras, Libras, and Hydras. The Lyra is a relatively inexpensive subcompact car that appeals mainly to first-time car owners and to households using it as a second car for commuting. The Libra is a sporty compact car that is sleeker, faster, and roomier than the Lyra. Without any options, the Libra costs slightly more than the Lyra; additional options increase the price. The Hydra is the luxury car of the GMC line. It is significantly more expensive than the Lyra and Libra, and it has the highest profit margin of the three cars.

Retooling options for capacity expansion:

Currently GMC has three manufacturing plants in the United States. Each plant is dedicated to producing a single line of cars. In its planning for the coming year, GMC is considering the retooling of its Lyra and/or Libra plants. Retooling either plant would represent a major expense for the company. The retooled plants would have significantly increased production capacities. Although having greater fixed costs, the retooled plants would be more efficient and have lower marginal production costs–that is, higher marginal profit contributions. In addition, the retooled plants would be flexible–they would have the capability of producing more than one line of cars.

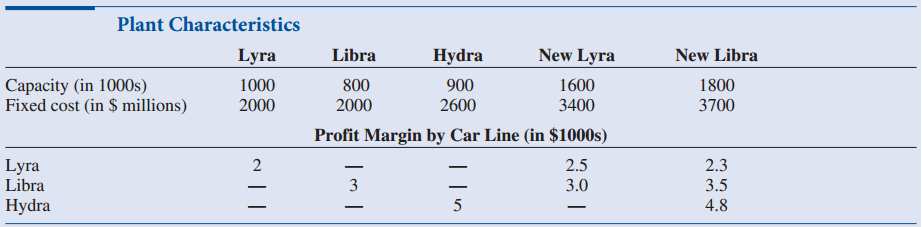

The characteristics of the current plants and the retooled plants are given in Table 6.9. The retooled Lyra and Libra plants are prefaced by the word new. The fixed costs and capacities in Table 6.9 are given on an annual basis. A dash in the profit margin section indicates that the plant cannot manufacture that line of car. For example, the new Lyra plant would be capable of producing both Lyras and Libras but not Hydras. The new Libra plant would be capable of producing any of the three lines of cars. Note, however, that the new Libra plant has a slightly lower profit margin for producing Hydras than the Hydra plant. The flexible new Libra plant is capable of producing the luxury Hydra model but is not as efficient as the current Hydra plant that is dedicated to Hydra production.

The fixed costs are annual costs incurred by GMC, independent of the number of cars produced by the plant. For the current plant configurations, the fixed costs include property taxes, insurance, payments on the loan that was taken out to construct the plant, and so on. If a plant is retooled, the fixed costs will include the previous fixed costs plus the additional cost of the renovation. The additional renovation cost will be an annual cost representing the cost of the renovation amortized over a long period.

Demand for GMC cars:

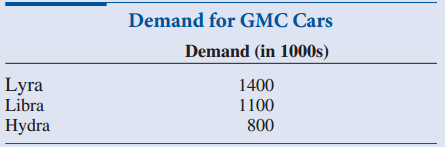

Short-term demand forecasts have been very reliable in the past and are expected to be reliable in the future. The demand for GMC cars for the coming year is given in Table 6.10.

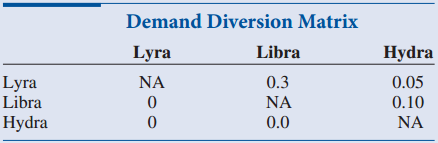

A quick comparison of plant capacities and demands in Table 6.9 and Table 6.10 indicates that GMC is faced with insufficient capacity. Partially offsetting the lack of capacity is the phenomenon of demand diversion. If a potential car buyer walks into a GMC dealer showroom wanting to buy a Lyra but the dealer is out of stock, frequently the salesperson can convince the customer to purchase the better Libra car, which is in stock. Unsatisfied demand for the Lyra is said to be diverted to the Libra. Only rarely in this situation can the salesperson convince the customer to switch to the luxury Hydra model. From past experience, GMC estimates that 30% of unsatisfied demand for Lyras is diverted to demand for Libras and 5% to demand for Hydras.

Similarly, 10% of unsatisfied demand for Libras is diverted to demand for Hydras. For example, if the demand for Lyras is 1,400,000 cars, then the unsatisfied demand will be 400,000 if no capacity is added. Out of this unsatisfied demand, 120,000 (= 400,000 × 0.3) will materialize as demand for Libras, and 20,000 (= 400,000 × 0.05) will materialize as demand for Hydras. Similarly, if the demand for Libras is 1,220,000 cars (1,100,000 original demand plus 120,000 demand diverted from Lyras), then the unsatisfied demand for Lyras would be 420,000 if no capacity is added. Out of this unsatisfied demand, 42,000 (= 420,000 × 0.1) will materialize as demand for Hydras. All other unsatisfied demand is lost to competitors. The pattern of demand diversion is summarized in Table 6.11.

Table 6.9:

Table 6.10:

Table 6.11:

A dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the...

Step by Step Answer: