Expand and then solve the capital budgeting model in Figure 6.5 so that 20 investments are now

Question:

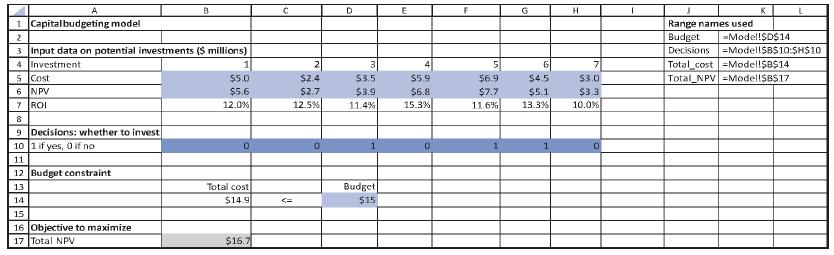

Expand and then solve the capital budgeting model in Figure 6.5 so that 20 investments are now possible. You can make up the data on cash requirements, NPVs, and the budget, but use the following guidelines:

• The cash requirements and NPVs for the various investments can vary widely, but the ROIs should be between 10% and 15% for each investment.

• The budget should allow somewhere between 5 and 10 of the investments to be selected.

Figure 6.5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: