11.12. Assume that a non-dividend-paying stock has an expected return of and a volatility of . An...

Question:

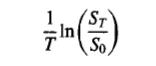

11.12. Assume that a non-dividend-paying stock has an expected return of and a volatility of . An innovative financial institution has just announced that it will trade a derivative that pays off a dollar amount equal to

at time T. The variables So and Sr denote the values of the stock price at time zero and time T.

a. Describe the payoff from this derivative.

b. Use risk-neutral valuation to calculate the price of the derivative at time zero.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: