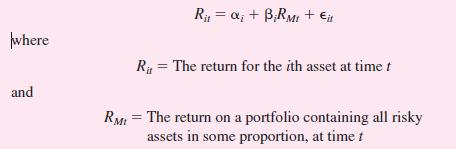

11.7 Assume that the following market model adequately describes the return-generating behavior of risky assets. RMt and...

Question:

11.7 Assume that the following market model adequately describes the return-generating behavior of risky assets.

RMt and it are statistically independent.

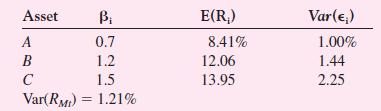

Suppose the following data are true.

a. Calculate the standard deviation of returns for each asset.

b. Assume short selling is allowed.

i. Calculate the variance of return of three portfolios containing an infinite number of asset types A, B, or C, respectively.

ii. Assume: RF = 3.3% and![]() . Which asset will not be held by rationalinvestors?

. Which asset will not be held by rationalinvestors?

iii. What equilibrium state will emerge such that no arbitrage opportunities exist? Why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: