26.4 The Optimal Scam Company would like to see its sales grow at 20 percent for the...

Question:

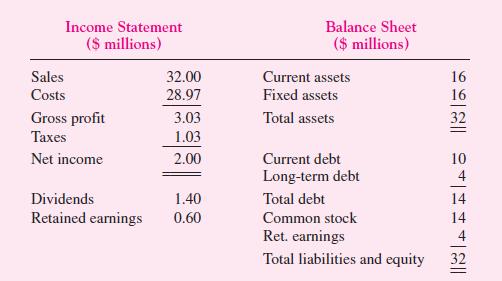

26.4 The Optimal Scam Company would like to see its sales grow at 20 percent for the foreseeable future. Its financial statements for the current year are presented below.

The current financial policy of the Optimal Scam Company includes Dividend-payout ratio

(d) = 70%

Debt-to-equity ratio (L) = 77.78%

Net profit margin (P) = 6.25%

Assets-sales ratio (T) = 1

a. Determine Optimal Scam’s need for external funds next year.

b. Construct a pro forma balance sheet for Optimal Scam.

c. Calculate the sustainable growth rate for the Optimal Scam Company.

d. How can Optimal Scam change its financial policy to achieve its growth objective?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: