2.Shields Electric forecasts the following nominal cash flows on a particular project: The nominal interest rate is

Question:

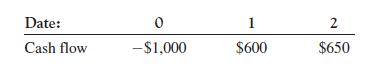

2.Shields Electric forecasts the following nominal cash flows on a particular project:

The nominal interest rate is 14 percent, and the inflation rate is forecast to be 5 percent.

What is the value of the project?

• What is the difference between the nominal and the real interest rate?

• What is the difference between nominal and real cash flows?

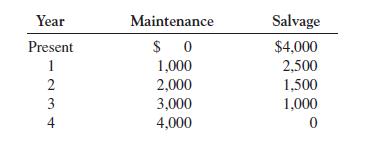

1. Consider the situation of BIKE. BIKE is contemplating whether to replace an existing machine or to spend money overhauling it. BIKE currently pays no taxes.

The replacement machine costs $9,000 now and requires maintenance of $1,000 at the end of every year for eight years. At the end of eight years it would have a salvage value of $2,000 and would be sold. The existing machine requires increasing amounts of maintenance each year, and its salvage value falls each year, as shown:

The existing machine can be sold for $4,000 now. If it is sold in one year, the resale price will be $2,500, and $1,000 must be spent on maintenance during the year to keep it running. For ease of calculation, we assume that this maintenance fee is paid at the end of the year. The machine will last for four more years before it falls apart. If BIKE faces an opportunity cost of capital of 15 percent, when should it replace the machine?

Step by Step Answer:

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe