7.16 Harry Gultekin, a small restaurant owner/manager, is contemplating the purchase of a larger restaurant from its

Question:

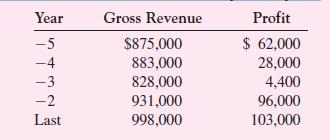

7.16 Harry Gultekin, a small restaurant owner/manager, is contemplating the purchase of a larger restaurant from its owner who is retiring. Gultekin would finance the purchase by selling his existing small restaurant, taking a second mortgage on his house, selling the stocks and bonds that he owns, and, if necessary, taking out a bank loan. Because Gultekin would have almost all of his wealth in the restaurant, he wants a careful analysis of how much he should be willing to pay for the business. The present owner of the larger restaurant has supplied the following information about the restaurant from the past five years.

As with many small businesses, the larger restaurant is structured as a Subchapter S corporation. This structure gives the owner the advantage of limited liability, but the pretax profits flow directly through to the owner, without any corporate tax deducted. The preceding figures have not been adjusted for changes in the price level. There is general agreement that the average profits for the past five years are representative of what can be expected in the future, after adjusting for inflation.

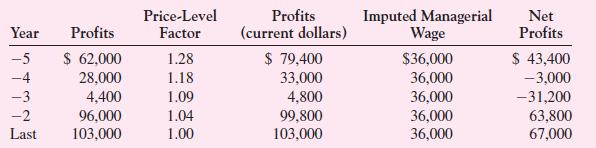

Gultekin is of the opinion that he could earn at least $3,000 in current dollars per month as a hired manager. Gultekin feels he should subtract this amount from profits when analyzing the venture. Furthermore, he is aware of statistics showing that for restaurants of this size, approximately 6 percent of owners go out of business each year.

Gultekin has done some preliminary work to value the business. His analysis is as follows:

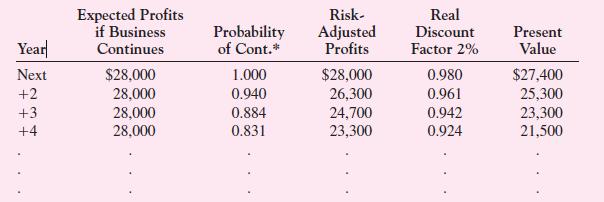

The average profits for the past five years, expressed in current dollars, are $28,000. Using this average profit figure, Gultekin produced the following figures. These figures are in current dollars.

Based on these calculations, Gultekin has calculated that the value of the restaurant is $350,000.

a. Assume that there is indeed a 6 percent per year probability of going out of business.

Do you agree with Gultekin’s assessment of the restaurant? In your answer, consider his treatment of inflation, his deduction of the managerial wage of $3,000 per month, and the manner in which he assessed risk.

b. What present value would you place on the revenue stream; in other words, how much would you advise Gultekin that he should be willing to pay for the restaurant?

Step by Step Answer:

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe