7.29 Pilot Plus Pens is considering when to replace its old machine. The replacement costs $3 million

Question:

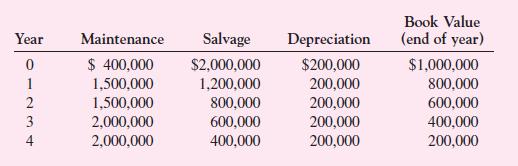

7.29 Pilot Plus Pens is considering when to replace its old machine. The replacement costs $3 million now and requires maintenance costs of $500,000 at the end of each year during the economic life of five years. At the end of five years the new machine would have a salvage value of $500,000. It will be fully depreciated by the straight-line method. The corporate tax rate is 34 percent and the appropriate discount rate is 12 percent. Maintenance cost, salvage value, depreciation, and book value of the existing machine are given as follows.

The company is assumed to earn a sufficient amount of revenues to generate tax shields from depreciation. When should the company replace the machine?

Step by Step Answer:

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe