At the end of 2002, Todd Pickett, CFO of Dell Mercosur, was faced with conflicting predictions of

Question:

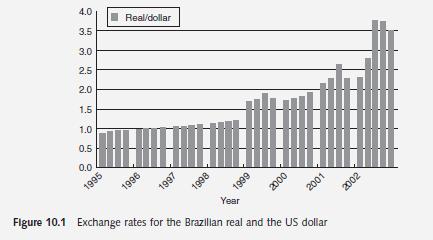

At the end of 2002, Todd Pickett, CFO of Dell Mercosur, was faced with conflicting predictions of the value of the Brazilian currency, the real, and what to do to hedge Dell’s operation in Brazil. Although Pickett was concerned about Dell’s exposure in the other Mercosur countries, especially Argentina, Brazil was clearly the largest concern. The year 2002 began with the shocks resulting from the Argentine financial crisis that started at the end of 2001, and it ended with the election in October of Luiz Ina’cio Lula da Silva, known simply as Lula, as the president of Brazil. Lula, the leader of the Worker’s Party and long-time leftist politician, had held the lead throughout the year. The markets were skeptical of Lula’s potential leadership, a factor that caused the real to fall from 2.312 reals per US dollar at the end of 2001 to a record 4 reals to one US dollar at one point just prior to the election. After the election, the real began to strengthen somewhat, but Pickett had to base his strategies on whether the real would continue to strengthen or would weaken again. Figure 10.1 shows the Brazilian real/US dollar exchange rate changes for 1995 through 2002.

The History of Dell Founded in 1984 by Michael Dell, the computer company operates in 34 countries with 36,000 employees (of which about 14,400 are outside the USA) and recorded $32 billion in sales for 2002. In the past 5 years, Dell has expanded beyond PCs, to servers, storage, and communications equipment. Most PC manufactures have claimed poor results since the technology bubble burst in 2000 – IBM left the industry in 2000 and Compaq and Hewlett-Packard (HP)

merged in 2001 in hopes of boosting their competitive position. Unlike its competitors, Dell has thrived in the past few years, moving from a market share of 12 percent to 15 percent in

2001, the number one spot in the industry. Fiscal 2002 was one of the toughest years to date in the PC industry. Because of the softening of the global economy and the events of September 11, demand for PCs was down sharply. Dell responded with an aggressive price strategy and reduced costs through workforce reductions and facility consolidations. Although global industry shipments fell in 2002 by 5 percent, Dell’s unit shipments increased by 15 percent, thus enabling the company to retain its number one position.

Dell bases its success on its build-to-order, direct sales model. Dell has eliminated resellers and retailers and sells directly to the customer by phone or over the Internet. Dell customizes every computer to the customer’s needs and waits to build the computer until it is ordered.

As a result, Dell requires little inventory (4 days on average) and is able to deliver the newest technology to its customers. Costs are kept to a minimum compared to its competitors, because it has no costly retail outlets and little inventory.

Dell began assembling computers in Round Rock, Texas, in 1985 and moved to global production in the following order:

Sales outside the USA accounted for approximately 35 percent of the company’s revenues in fiscal year 2002. The company’s future growth rates and success are dependent on continued growth and success in international markets. As is the case with most international operations, Dell’s overseas sales are subject to numerous risks and uncertainties, including local economic and labor conditions, political instability, unexpected changes in the regulatory environment, trade protection measures, tax laws (including US taxes on foreign operations), and foreign-currency exchange rates.

Dell in Brazil Dell’s production facility in Brazil is in Eldorado do Sul, close to Porto Alegre, the capital of Rio Grande do Sul, the southernmost state in Brazil. Its call center in Brazil is similar to the one in Bay, Ireland, and services both Brazil and Argentina. Its Brazilian facility, which consists of 100,000 square feet of leased property, is the smallest of its facilities outside the USA, but the potential in Brazil and Argentina is huge, and Dell is planning further expansion. Because of the tariff-free provisions of Mercosur and the close proximity of Dell’s manufacturing facilities in the south of Brazil, Dell is well positioned to service all of Mercosur with its Brazilian manufacturing operations. In 2002, it held a 4.5 percent market share in Brazil, behind HP/Compaq, IBM, and a Brazilian company. However, it was rapidly moving up to third place in the market and growing quickly.

Although Dell is divided into products and customers, it is managed generally on a geographical basis. Terry Kahler, the general manager of Dell Mercosur, reports to the head of the Americas/International group, who in turn reports to the Rosendo Parra, the Vice President of the Americas/International Group in Austin, Texas. Pickett works closely with Kahler, but reports directly to the CFO staff in Austin.

Dell’s revenues in Brazil are denominated in reals, and most of its operating costs are also denominated in reals. However, about 97 percent of Dell’s manufacturing costs in Brazil are denominated in US dollars, since Dell imports parts and components from the USA. It translates its financial statements according to the current-rate method, which means that assets and liabilities are translated at the average exchange rate for the period. Because of business development loans from the Brazilian government, Dell’s net exposed asset position in Brazil is quite small, but it is subject to foreign-exchange gains and losses as the rate changes.

The Hedging Strategy In its Form 10K for 2002, Dell states its foreign-currency hedging strategy as follows:

The Company’s objective in managing its exposure to foreign currency exchange-rate fluctuations is to reduce the impact of adverse fluctuations on earnings and cash flows associated with foreign currency exchange-rate changes. Accordingly, the Company utilizes foreign currency option contracts and forward contracts to hedge its exposure on forecasted transactions and firm commitments in most foreign countries in which the Company operates. The principal currencies hedged during fiscal 2002 were British pound, Japanese yen, euro, and Canadian dollar. The Company monitors its foreign currency exchange exposures to ensure the overall effectiveness of its foreign currency hedge positions. However, there can be no assurance the Company’s foreign currency activities will substantially offset the impact of fluctuations in currency exchange rates on its results of operations and financial position.

The Company uses purchased option contracts and forward contracts designated as cash flow hedges to protect against the foreign currency exchange risk inherent in its forecasted transactions denominated in currencies other than the US dollar. Hedged transactions include international sales by US dollar functional currency entities, foreign currency denominated purchases of certain components, and intercompany shipments to certain international subsidiaries. The risk of loss associated with forward contracts is entered into until the time it is settled. These contracts generally expire in three months or less.

The Company also uses forward contracts to economically hedge monetary assets and liabilities, primary receivables and payables that are denominated in a foreign currency.

These contracts are not designated as hedging instruments under generally accepted accounting principals, and therefore, the change in the instrument’s fair value is recognized currently in earnings and is reported as a component of investment and other income (loss), net. The change in the fair value of these instruments represents a natural hedge as their gains and losses offset the changes in the underlying fair value of the monetary assets and liabilities due to movements in currency exchange rates. These contracts generally expire in three months or less.

Based on these general statements of principle, Dell’s strategy is to hedge all foreignexchange risk, which is a very aggressive hedging strategy. Since there is no options market for Brazilian reals, Pickett uses forward contracts to hedge the foreign-exchange risk in Brazil.

Corporate treasury monitors currency movements worldwide and provides support to Pickett’s Brazilian treasury group in terms of currency forecast and hedging strategies. Within the broad strategy approved by corporate treasury, the Brazilian group establishes a strategy and then works with corporate on specific executions of the strategy.

There are two key parts to the strategy. One has to do with forecasting exposure, and the other has to do with designing and executing the strategy to hedge the exposure. Although the balance-sheet exposure is not material, it still must be forecast and is partly a function of the cash flows generated by revenues. The revenue side is more difficult to forecast, so Pickett hedges about 80 percent of forecasted revenues. However, the Dell team in Brazil has become very adept at forecasting revenues and in executing a strategy in order to reach its target forecast.

The team works hard on identifying the challenges in reaching its target and in devising policies to overcome those challenges. Its execution strategies vary widely quarter by quarter, and the management team has become very good at meeting its targets by working closely together and being flexible. Pickett and Kahler work closely together on a daily basis to execute their strategy.

The second key to this strategy is designing and executing the hedging strategy. Since revenues vary on a daily basis, Pickett does not enter into contracts all at once. Instead, he works with corporate treasury to enter into contracts in different amounts and different maturities depending on when it expects to generate the revenues. Revenues are generally lower at the beginning of the quarter and are always higher in the last week or two of the quarter, so he enters into contracts accordingly. Timing is a crucial issue. The gain or loss on a forward contract is the difference in exchange rates between when the contract is entered into and when it is settled. The key is to unwind (or settle) the contracts while the rate is still favorable. Pickett noted that if Dell began to unwind the contracts in the last week or two of the quarter instead of the last day or two of the quarter, it could get much more favorable foreign-exchange gains. His strategy was so successful that in some quarters, Dell was generating more financial income than operating income. Although Pickett and his treasury team have some flexibility in designing and implementing strategy, corporate treasury keeps in touch, depending on their forecast of exchange rate and the strategy that Dell Brazil is following.

Corporate treasury uses a consensus forecast of exchange rates that is provided by a group of banks, but banks have different scenarios. For example, in the last quarter of 2002, corporate treasury was relying on a bank forecast that the real would revalue even more by the end of the year. Pickett’s dilemma was that his gut feeling was that the real would actually fall instead of rise. That would indicate a different hedging strategy. He was resisting entering into hedges while corporate treasury was pressuring him to do just that. However, he was closely watching the forward market, and when it began to move, he decided it was time to enter into the contracts. But who knows what will happen to Brazil if Lula, Brazil’s new president, loses fiscal control of the ninth largest economy in the world, resulting in another round of inflation and a falling currency. Dell has significant market opportunities in Mercosur, but the financial risk will make for exciting times in the years to come.

Case Questions 1 Given how Dell translates its foreign-currency financial statements into dollars, how would a falling Brazilian real affect Dell Mercosur’s financial statement?

2 Dell imports about 97 percent of its manufacturing cost. What type of exposure does this create for it? What are its options to reduce that exposure?

3 Describe and evaluate Dell’s exposure management strategy.

4 What are the costs and benefits of hedging all foreign-exchange risk?

5 The mission of the Financial Accounting Standard Board (FASB) is to establish and improve standards of financial accounting and reporting for the guidance and education of the public, including issuers, auditors, and users of financial information. Visit the FASB’s home page, www.fasb.org, to see current accounting standards and letters commenting on proposed standards.

Step by Step Answer:

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim