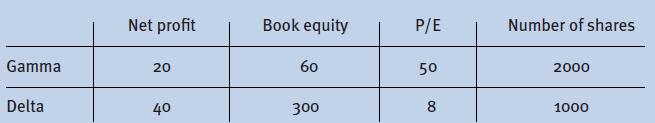

Below are the key figures for Gamma plc and Delta plc: (a) Gamma acquires Delta. The criterion

Question:

Below are the key figures for Gamma plc and Delta plc:

(a) Gamma acquires Delta. The criterion selected for calculation purposes is equity value. Calculate the old and new EPS, equity per share, and the percentage of the shareholdings of the former shareholders of Gamma in the new entity.

(b) Redo the calculations with a P/E for Gamma of only 15, and then 6.

(c) What are the minimum and maximum relative values if the synergies that come out of the merger increase the profits of the new group by 10, and if the new group is valued on the basis of a P/E of 21? What would the ratios be then?

(d) What is the value of Epsilon, the new name for the merged Gamma and Delta (still with synergies of 10) if it is valued on the basis of a P/E of 50?

(e) What is the value created and what does it represent?

Step by Step Answer:

Corporate Finance Theory And Practice

ISBN: 9780470721926

2nd Edition

Authors: Pierre Vernimmen, Pascal Quiry