Construct a combined common-size and common-base year balance sheet for 2007. What will be the common-base year

Question:

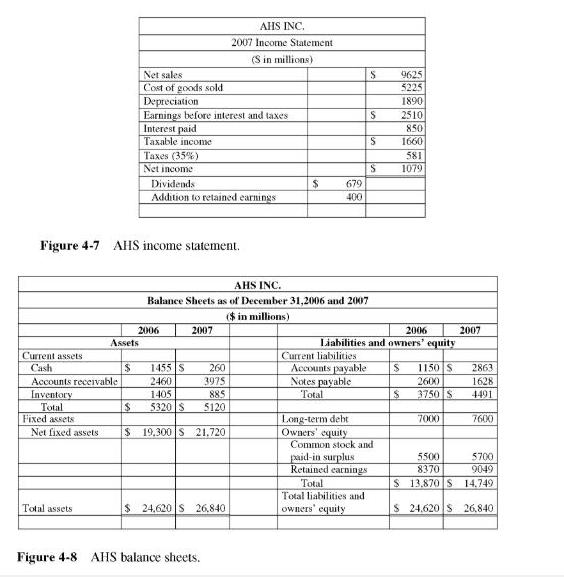

Construct a combined common-size and common-base year balance sheet for 2007. What will be the common-base year value for the 2007 net fixed assets?

a. 0.89

b. 0.92

c. 1.12

d. 1.32

Transcribed Image Text:

AHS INC. 2007 Income Statement (S in millions) Net sales S 9625 Cost of goods sold 5225 Depreciation 1890 Earnings before interest and taxes $ 2510 Interest paid 850 Taxable income S 1660 Taxes (35%) Net income 581 S 1079 Dividends $ 679 Addition to retained earnings 400 Figure 4-7 AHS income statement. AHS INC. Balance Sheets as of December 31,2006 and 2007 ($in millions) 2006 2007 2006 2007 Assets Liabilities and owners' equity Current assets Current liabilities Cash $ Accounts receivable 1455 S 2460 260 Accounts payable $ 1150 S 2863 3975 Notes payable 2600 1628 Inventory 1405 885 Total S 3750 S 4491 Total $ 5320 $ 5120 Fixed assets Long-term debt 7000 7600 Net fixed assets $ 19.300 S 21.720 Owners' equity Total assets $ 24,620 S 26,840 Figure 4-8 AHS balance sheets. Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity 5500 5700 8370 9049 $ 13.870 S 14.749 $ 24.620 S 26,840

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Utilizing resoorces, complete a risk audit of Bank of Americas project to acquire Merrill Lynch. Ensure you address all 10 critical success factors. From the evidence of your audit, would you advise...

-

Consider the following information: Rate of Return if State Occurs State of Economy Boom :57 Bust of Economy .66 .34 Probability of State Stock A .09 .13 Stock B Stock C .03 .19 .24 -.04 a. What is...

-

How can we use these theories to analyze factors which influence the longevity and adaptability of these organizations in changing landscapes?

-

List all ways to get two successes out of four trials, and find the probability of each outcome. Suppose the probability of a success is p. Find the probability of each of the above event and compare...

-

What is a CpG island? Where would you expect one to be located? How does the methylation of CpG islands affect gene expression?

-

Procter and Gamble (P&G) and Unilever are the two leading firms in the consumer products industry for offerings such as soap, shampoo, and laundry detergent. P&G (www.pg.com) is based in the United...

-

Why might a manager be forced to use simulation instead of an analytical model in dealing with a problem of (a) Inventory ordering policy? (b) Ships docking in a port to unload? (c) Bank teller...

-

Ahrned is a manager in a construction company. He has been receiving complaints from employees that there are several tools and equipments are missing from the company store. Ahmed was wondering who...

-

What will be the value of AHS' current ratio during 2007? a. 1.14 b. 1.42 c. 1.49 d. 1.53 AHS INC. 2007 Income Statement (S in millions) Net sales S 9625 Cost of goods sold 5225 Depreciation 1890...

-

Using 2006 as the base year, construct a common-base year balance sheet for 2007 for AHS. According to this statement, which of the following items have grown the most compared to their 2006 values?...

-

The records of Paramount Color Engraving reveal the following: Compute cash flows from operating activities by the indirect method for year ended December 31, 2016. $40,000 Depreciation expense Net...

-

Nequired information Exercise 5-17 (Static) Notes receivable-interest accrual and collection LO 5-6 (The following information applies to the questions displayed below) Agrico Incorporated accepted...

-

Case 14-3 Sarin Pharmaceuticals Ltd. Alan Mannik, director of procurement for the Sarin Phar- maceuticals Ltd. (Sarin) Animal Health Division plant in Vancouver, British Columbia, was planning for...

-

CL727 LEGAL ANALYSIS AND WRITING Module 11 Assignment: Brief Answer, Analysis, and Conclusion This assignment will be due in Module 11. Your assignment is to write the Brief Answer, Analysis, and...

-

Question 11 (0.5 points) l) Listen } As a drug manufacturer, you expect your latest wonder drug to lower cholesterol. It has been successful with a limited group of participants so far, so you have...

-

Redfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two wireless models, Standard and Enhanced, which differ both in the materials and components used and...

-

Follow the impact of a $100 cash withdrawal through the entire banking system, assuming that the reserve requirement is 10 percent and that banks have no desire to hold excess reserves.

-

1. Use these cost, revenue, and probability estimates along with the decision tree to identify the best decision strategy for Trendy's Pies. 2. Suppose that Trendy is concerned about her probability...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App