Ellingham plc opens a Spanish subsidiary, which starts operating on 2 January 2005. On 2 January 2005

Question:

Ellingham plc opens a Spanish subsidiary, which starts operating on 2 January 2005.

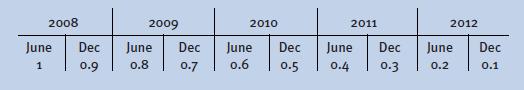

On 2 January 2005 it has to buy a machine costing BC30m, partly financed by a BC20m bank loan repayable in instalments of BC2m every 15 July and 15 January over 5 years.

Financial expenses, payable on a half-yearly basis, are as follows:

Profits are tax-free. Sales will be BC12m per month. A month’s inventory of finished products will have to be built up. Customers pay at 90 days.

The company is keen to have a month’s worth of advance purchases and, accordingly, plans to buy two months’ worth of supplies in January 2008. Requirements in a normal month amount to BC4m.

The supplier grants the company a 90-day payment period. Other costs are:

◦ personnel costs of BC4m per month;

◦ shipping, packaging and other costs, amounting to BC2m per month and paid at 30 days. These costs are incurred from 1 January 2008.

Draw up a monthly and an annual cash flow plan.

How much cash will the subsidiary need at the end of each month over the first year?

And if operations are identical, how much will it need each month over 2009? What is the change in the cash position over 2009 (no additional investments are planned)?

Step by Step Answer:

Corporate Finance Theory And Practice

ISBN: 9780470721926

2nd Edition

Authors: Pierre Vernimmen, Pascal Quiry