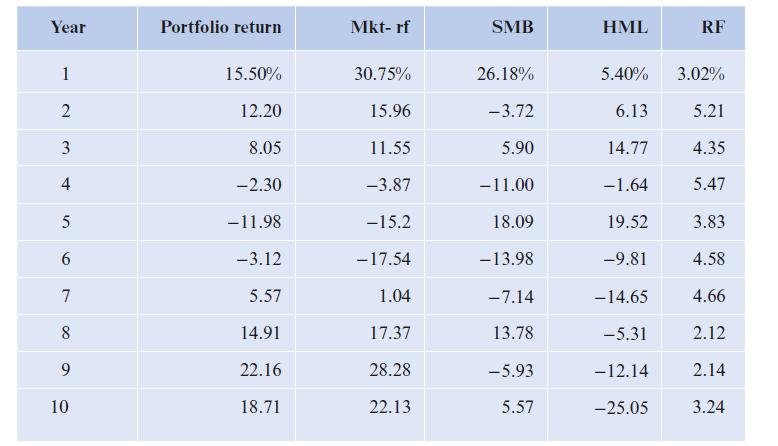

Fama-French Model You have run a portfolio for the past ten years, to the following returns. In

Question:

Fama-French Model You have run a portfolio for the past ten years, to the following returns. In addition, you have the Fama-French factors for that period of time.

(a) You assume the expected return on the market is the average of the market return (from the table). Same with the risk-free rate. Given this, what is the expected return on the portfolio according to CAPM?

(b) Again assuming the expected SMB and HML values are the averages of the historical values provided, use all three factors to predict the risk premium of the portfolio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Applied Corporate Finance Making Value Enhancing Decisions In The Real World

ISBN: 9783030816308

2nd Edition

Authors: Mark K. Pyles

Question Posted: