Question:

Given the yield curve as published by the financial press, consider a coupon bond has a face value of $1,500, an annual coupon rate of 3.9%, makes 2

(semiannual) coupon payments per year, and 8 periods to maturity (or 4 years to maturity). Determine the price and yield to maturity of this coupon bond based on the Effective Annual Rate (EAR) convention. Then use it to determine the price and yield to maturity of this coupon bond based on the Annual Percentage Rate (APR) convention.

Transcribed Image Text:

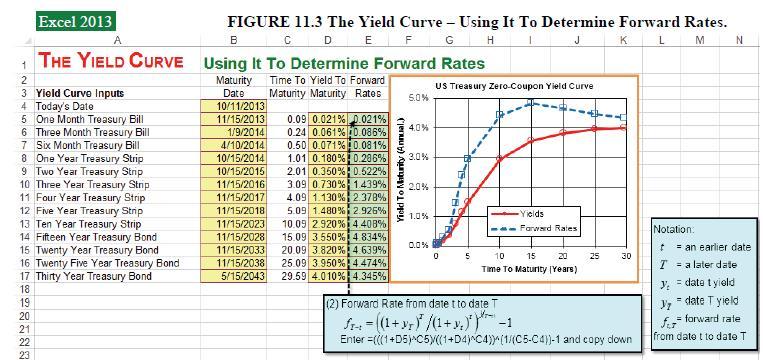

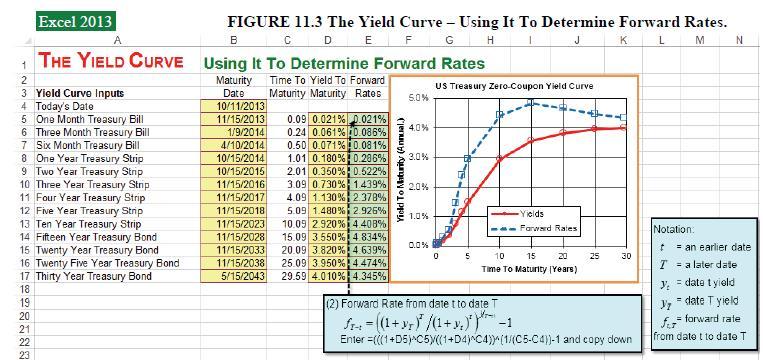

Excel 2013 FIGURE 11.3 The Yield Curve - Using It To Determine Forward Rates. C D E F G KL B THE YIELD CURVE Using It To Determine Forward Rates H J M N 3 Yield Curve Inputs 4 Today's Date 5 One Month Treasury Bill 6 Three Month Treasury Bill 7 Six Month Treasury Bill 8 One Year Treasury Strip 9 Two Year Treasury Strip 10 Three Year Treasury Strip 11 Four Year Treasury Strip 12 Five Year Treasury Strip 11/15/2016 3.09 0.730 % 1.439% 11/15/2017 4.09 1.130% 2.378% 11/15/2018 5.09 1.480 % 2.926% Maturity Date 10/11/2013 Time To Yield To Forward Maturity Maturity Rates US Treasury Zero-Coupon Yield Curve 5.0% 11/15/2013 1/9/2014 4/10/2014 0.09 0.021% 0.021% 0.24 0.061% 0.086% 0.50 0.071% 0.081% 10/15/2014 1.01 0.180% 0.286% 10/15/2015 2.01 0.350% 0.522 % Yield To Maturity (Annual) 4.0% 3.0% 2.0% 1 12 1.0% 13 Ten Year Treasury Strip 14 Fifteen Year Treasury Bond 15 Twenty Year Treasury Bond 16 Twenty Five Year Treasury Bond 17 Thirty Year Treasury Bond 18 11/15/2038 11/15/2023 10.09 2.920 % 4.408% 11/15/2028 15.09 3.550% 4.834% 11/15/2033 20.09 3.820% 4.639% 25.09 3.950% 4.474% Yields --Farward Rates Notation: 0.0% f 0 5 10 15 20 Time To Maturity (Years) 25 30 = an earlier date Ta later date 19 20 21 22 23 5/15/2043 29.59 4.010% 4.345% (2) Forward Rate from date t to date T S=((1+r)/(1+ y)-1 Enter =(((1+D5) C5)/((1+D4) C4)) (1/(C5-C4))-1 and copy down y: = date t yield = date T yield = forward rate from date t to date T