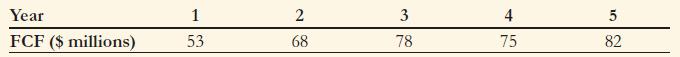

Heavy Metal Corporation is expected to generate the following free cash flows over the next five years:

Question:

Heavy Metal Corporation is expected to generate the following free cash flows over the next five years:

After then, the free cash flows are expected to grow at the industry average of 4% per year.

Using the discounted free cash flow model and a weighted average cost of capital of 14%:

a. Estimate the enterprise value of Heavy Metal.

b. If Heavy Metal has no excess cash, debt of $300 million, and 40 million shares outstanding, estimate its share price.Appendix

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: