Holding operating earnings constant, an increase in the marginal tax rate to 40% would: A. result in

Question:

Holding operating earnings constant, an increase in the marginal tax rate to 40% would:

A. result in a lower cost of debt capital.

B. result in a higher cost of debt capital.

C. not affect the company’s cost of capital.

Barbara Andrade is an equity analyst who covers the entertainment industry for Greengable Capital Partners, a major global asset manager. Greengable owns a significant position with a large unrealized capital gain in Mosely Broadcast Group (MBG). On a recent conference call, MBG’s management states that they plan to increase the proportion of debt in the company’s capital structure. Andrade is concerned that any changes in MBG’s capital structure will negatively affect the value of Greengable’s investment.

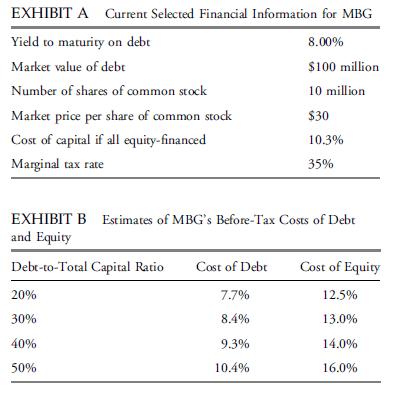

To evaluate the potential impact of such a capital structure change on Greengable’s investment, she gathers the information about MBG given in Exhibit A.

Andrade expects that an increase in MBG’s financial leverage will increase its costs of debt and equity. Based on an examination of similar companies in MBG’s industry, Andrade estimates MBG’s cost of debt and cost of equity at various debt-to-total capital ratios, as shown in Exhibit B.

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan