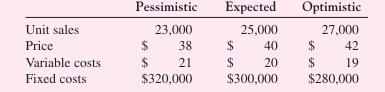

Ms. Thompson, as the CFO of a clock maker, is considering an investment of a ($420,000) machine

Question:

Ms. Thompson, as the CFO of a clock maker, is considering an investment of a \($420,000\) machine that has a seven-year life and no salvage value. The machine is depreciated by a straight-line method with a zero salvage over the seven years. The appropriate discount rate for cash flows of the project is 13 percent, and the corporate tax rate of the company is 35 percent. Calculate the NPV of the project in the following scenario. What is your conclusion about the project?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: