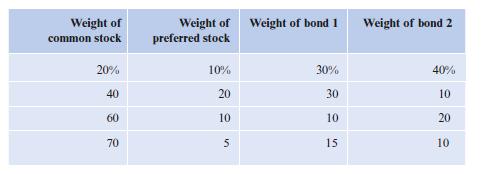

Optimal capital structure. Suppose a firm has four pieces of capital structure. They are as follows: 55

Question:

Optimal capital structure. Suppose a firm has four pieces of capital structure.

They are as follows:

55 Common stock that has a beta of 1.21. In addition, the market risk premium is 9.1% and the risk-free rate is 2.2%. The stock is selling for

$13.00 per share.

55 Preferred stock that has a cost of 5.4%.

55 Bond 1: Long-term corporate bonds with ten years left until maturity that are currently selling for $978.03 each. The coupon rate is 7.5% and the face value is $1,000. Payments are made semiannually.

55 Bond 2: Long-term corporate bonds that are selling for $1,004.87. The coupon rate is 8.41%, and there is 17 years left until maturity. Face value is $1,000, and payments are made semiannually.

55 Assuming the following represents the only available options, which is the optimal capital structure? The firm has a tax rate of 21%.

Step by Step Answer:

Applied Corporate Finance Making Value Enhancing Decisions In The Real World

ISBN: 9783030816308

2nd Edition

Authors: Mark K. Pyles