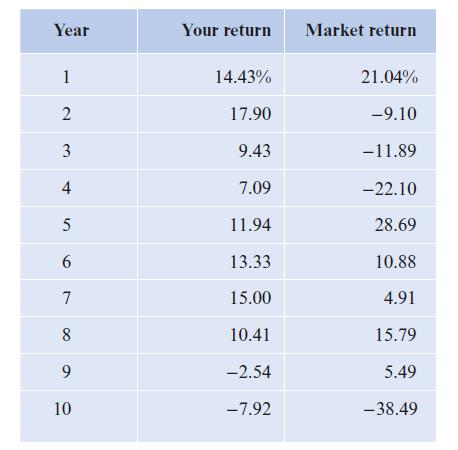

Portfolio returns You have had the following portfolio returns over the past ten years. Also included are

Question:

Portfolio returns You have had the following portfolio returns over the past ten years. Also included are the market returns for the same period of time.

You may assume that a market return in excess of 15% is a good market. Any negative return is a bad market. Everything in between is a normal market.

(a) The probability of a good year next year is 15%, while the probability of a bad year is 20%. Based upon this, what is your expected return?

(b) Based upon these values, what is your historical standard deviation?

(c) Based upon these values, what is the probability your return next year will be less than 5%?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Applied Corporate Finance Making Value Enhancing Decisions In The Real World

ISBN: 9783030816308

2nd Edition

Authors: Mark K. Pyles

Question Posted: