Sarvon Systems has a debt-equity ratio of 1.2, an equity beta of 2.0, and a debt beta

Question:

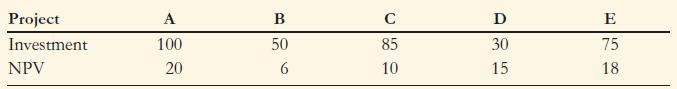

Sarvon Systems has a debt-equity ratio of 1.2, an equity beta of 2.0, and a debt beta of 0.30. It currently is evaluating the following projects, none of which would change the firm’s volatility

(amounts in $ million):

a. Which project will equity holders agree to fund?

b. What is the cost to the firm of the debt overhang?Appendix

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: